Theories Collide

Bitcoin Data Newsletter

Hello Everyone!

Welcome back to the Bitcoin Data Newsletter!

Last time, our newsletter topic was: “It’s Just the Beginning”. There I showed how according to how far moves have typically run before they find a local high, we should be finished at just under $35,000.

I showed you this chart:

The next target we were eyeing according to the magic bands and a similar percentage increase was $38,832. Price just hit $38,000 which now might call for the second part of the projection, 32k.

We’ll be taking a look to see if that’s still the case!

I’ll also be discussing my current thoughts on the market and a brand new theory I just developed for the cycles.

Let’s dive right in.

This Newsletter Will Cover….

Short-Term Thoughts - Fibonacci Perfection

Market Comments - Bears and Bulls Get Along

Long-Term Analysis - Theories Collide

Investor Psychology - Boring is the Time to Buy

Short-Term Thoughts

Fibonacci Perfection

While creating the chart, price has continued to form a correction.

This is more or less what I have been expecting after the touch of $38,000. While it didn’t respect the secondary level of the magic bands perfectly ($38,900) it was close enough to call it significant.

Here I have displayed a specific Fibonacci extension. The retrace points are inside of the circles labeled 1 and 0.

For every local high so far, price has respected the next Fibonacci extension level, and that hasn’t changed even with the latest touch of the purple 3.618.

Now typically, after touching the next Fibonacci level extension level, price has retraced to the previous. This would mean a price of about $31,000.

However, I don’t think that’s what’s most likely.

Because I think we are en route to the cycle mid-top, I don’t think we’ll see as harsh a pullback as we did earlier in the year.

There is a large level of liquidity (not shown) lying around 34k which seems to be a more likely target for the short term.

I have drawn a secondary, lighter green path that does retest 31k as an alternate scenario though.

It is also possible that the cycle mid-top or the end of the next move comes around the next Fibonacci extension to complete the pattern. Even though this is less than the 48k target you may have seen, it is a distinct possibility which I talked about extensively in yesterday’s newsletter. I also discussed the correction you are seeing now there.

We have run into some temporary resistance on data as I showed in yesterday’s post on X, and a correction here is good from these levels after so much rise.

Let’s keep an eye on the 33.3k - 34.5k level for a pullback in the short term.

Market Comments

Bears and Bulls Get Along

Besides fear and greed data, sentiment in the crypto space seems mostly neutral in my opinion.

Comments on X posts are well-balanced, with not too much anger from either side.

When one side gets overly angry and vocal, it can sometimes signal a turning point in favor of the opposite.

For example, many bears were very angry at the last 25k low, most comments were about how poor the macro conditions were (I am still seeing these comments surprisingly) and how stupid bulls were.

Of course, we have seen a turnaround from that point.

Even after 1000s of dollars of rise while bulls have been excited, I don’t see them stomping on graves yet. (this is usually when the hand reaches up to pull them under).

Besides other’s thoughts on the market, everything seems to be continuing right on track.

Since many important resistances have been broken to the upside, I see no reason why price can’t continue after a standard correction.

Let’s be patient for the short-term to play out.

Long-Term Analysis

Theories Collide

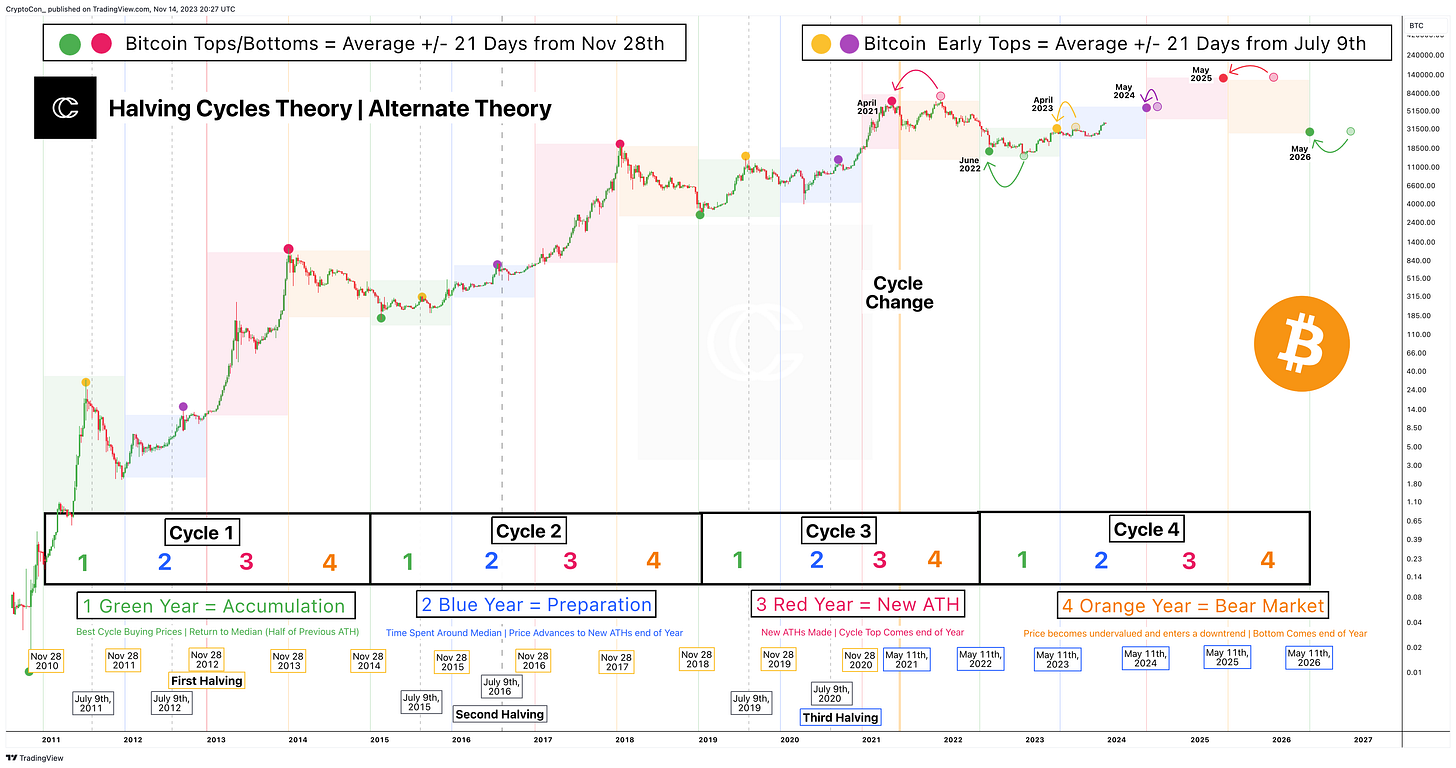

Today I introduced a brand new Theory for Bitcoin cycles called the Alternate Theory.

I wanted to discuss it here in more detail so you can see my thoughts.

Let’s first take a look at the Halving Cycles Theory:

If you would like the full breakdown of how this Theory works you can read it here at the top of Cycle Labs.

This theory says that Bitcoin is centered around the date of the first halving (November 28th, 2012), and the second (July 9th, 2012) has also marked a significant date for early tops (yellow and purple dots).

It tells us when Bitcoin will top and bottom, and what happens inside a given year. You can read the descriptions for each colored year on the chart.

So far, the theory has remained right on track since its creation as the November 28th Cycles Theory.

It called the bottom that came +/- 21 days from November 28th, 2022 right on schedule. It said that price would move to the median which is half of the previous ATH ($34,500) and we did.

It also said you would get the best cycle buying prices, hence the title (accumulation year).

The second early top then came according to schedule +/- 21 days from July 9th, 2023. (yellow dot)

Even so, I believe there is another way to look at this, despite the exactness of the model.

What if price action is trying to tell us that the pattern is about to shift?

Before we continue, I want to give a quick shout-out to my premium newsletter.

I have turned down hundreds of scams, promotions, and affiliates to focus on the only thing that I sell, more information to make sure you’re prepared to make the right long-term buying and selling Bitcoin and Altcoin Decisions.

I have three titles under my belt of doing exactly this. Buying Bitcoin under 10k last cycle, selling everything at 54k in April 2021, and now being all in from 16.5k in Nov 2022.

Not only do you get the most information that you need to succeed from someone who has done it, but also these other benefits:

Private Telegram Group Access

Much longer Bitcoin Newsletters and Exclusive Information

More Videos (Wednesday - Saturday)

Dollar Cost Averaging Tools to Scale in and Scale-out of ETH, BTC, and Alts

An Entire Newsletter Dedicated to Altcoins

Premium Charts Page with Live TradingView Charts

Voiceover of Newsletters

Time Sensitive Updates

Full Information on My Long-Term Buy and Sell Decisions

Full Cycle Labs Access

DCA Journey Access (An Account that Follows my DCA Tools)

Altcoin Tracker page to view all of my Altcoin analysis.

Full Models Page Access

+ Even more to come!

I have made sure the value is worth the price. Only more is on the horizon. If you want to make sure you are prepared for the right long-term decisions, you can join us right here:

Enter, The Alternate Theory:

Although we haven’t seen proof of this yet, price has left subtle hints on technicals that cycles may be shifting left by 6 months to enter around the date of our latest halving: May 11th, 2020.

Indicators and data abroad gave different dates for the previous cycle top and bottom.

Instead of the top being in November 2021, data said the top was in April 2021.

Instead of the bottom in November 2022 during the FTX crash, data called for a bottom in June 2022.

I’ll show you what I mean quickly on MVRV-Z:

The November 2021 top (purple arrow) came nowhere near the topping level on almost any data I have reviewed, while April fits the picture.

June 2022 was the first bottoming point inside the green zone, yet the bottom in price was in November during a seemingly “unforeseen” event like the FTX crash.

It sure did line up with the Halving Cycles Theory well… strange coincidence.

Let’s turn back to the Alternate Theory:

If indeed technicals are trying to tell us that the cycles are starting to shift left, we should pay attention.

The good thing is we should be able to tell which Theory is being followed over the other.

For now, the Alternate Theory remains only an idea until price makes a firm move that challenges the Halving Cycles because, in the end, price is king.

Specifically, we need to pay attention to Blue Year.

In the Alternate Theory, we are already in Blue Year, which means that price should advance to new ATHs by May 11th, 2024, and make them after that date. This will differentiate it from the Halving Cycles which says that shouldn’t be until November 28th, 2024.

According to the Alternate Theory, we could also see an early top by April instead of June. This would line up with a potential ETF approval.

After this takes place, price could start its journey to new highs shortly after (according to the Alternate Theory).

Our cycle top would then come around May 2025 instead of November 2025.

I will continue to keep everyone posted on my thoughts.

Investor Psychology

Boring is the Time to Buy

Almost like clockwork, I start to receive messages about purchasing different coins when things are exploding, and on the rise.

I am here to help you, and I want you to shift your mentality.

As I reflect, almost all of the best opportunities have one thing in common: they are incredibly boring.

Think about it…

Even most recently, when Bitcoin was doing absolutely nothing at 26k, Altcoins were bleeding and some making new lows, it was dreary and miserable.

But you can now see it with new eyes, it was the time to buy!

I have created a saying that has probably already been said, but I haven’t seen it anywhere and will adopt it for myself:

Price up, risk up

Price down, risk down

Instead of thinking about price this way, many start to concern themselves with how they feel.

Most people didn’t buy at 25k because they were either feeling greedy for lower prices like 20 - 21k, or fearful that their investment value would drop after due to macro concerns, or something else.

But what if you just thought simply, Price down, risk down.

You would have said the odds are now more in my favor if I buy here, not less because of how it feels.

Not to mention the plethora of long-term data that called for a bottom in that area, but thinking this way makes it even more simple.

Now apply that to our current price action:

Price is relatively high, but is starting to drop.

I would say the risk is high, but starting to come down.

The more price falls, the lower your risk. This applies to both Bitcoin and Altcoins.

The right times to buy can also be identified by like I said earlier, incredibly boring periods. Technically speaking, periods of low volatility, which can be measured. You can see an example of where I identified that in this X post back at 25 - 26k.

Volatility is picking up, and things are getting more exciting. Using our simple code, this would mean it is not the time to buy.

You will have your chance again, it is normal to feel as if it will run away forever but what goes up, must come down.

Work on training your mind this way by looking at the price and repeating the phrase:

Price up, risk up

Price down, risk down

Also ask, how boring does the price action seem? More boring = better opportunity.

Long-term data will then help you take this simple mindset to the next level, but you have to have the basics down first.

That’s all for today’s newsletter, I hope you enjoyed! If you did, be sure to leave a like on this post, it helps me out a lot.

I hope you all have an amazing week, and I will see you next time!

Best wishes,

CryptoCon

Price down, Risk down- sounds like a good tattoo!

I think now with the alternate theory we are fully prepared for the next run. Now the picture is complete in my eyes. How do you feel about it?

This also now lining up with the 3.5 year liquidity cycle which everyone starting to talk about (from Raoul Pal to TechDev)