Hello Everyone!

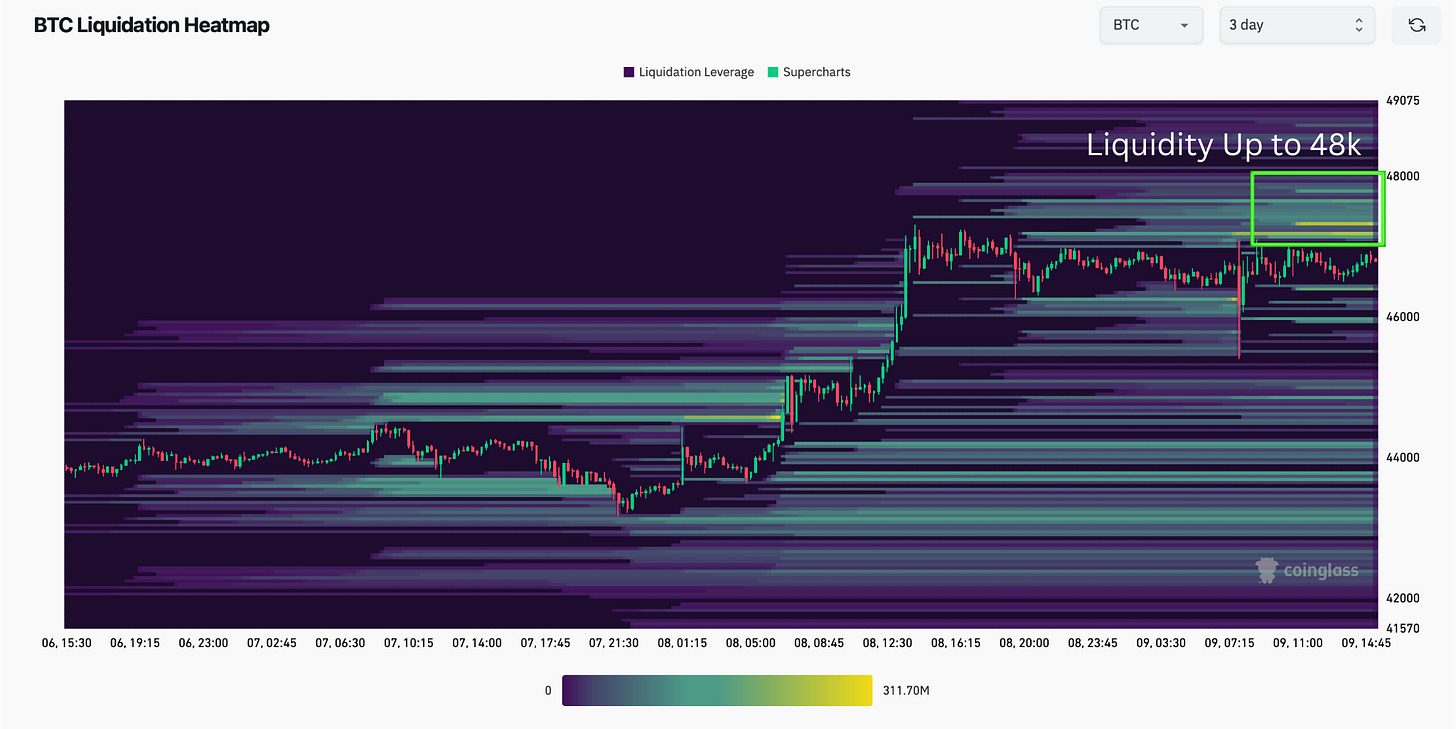

In the last Bitcoin Data Newsletter, we talked about “The Power of Speculation” and the likely move to 48k according to the liquidation heatmap:

Bitcoin did just that and has since corrected to prices around $38,500.

On X, I have made my stance clear that I believe further correction is in the cards down to the 30k region. I’ll be showing more short, and long-term evidence of why I believe this is the case along with my thoughts on the market overall.

I’ll also be discussing an important topic in investor psychology, risk vs reward.

These two things should guide each decision we make in crypto.

Let’s get started!

This Newsletter Will Cover….

Short-Term Thoughts - Price and Data

Market Comments - This Time is Different

Long-Term Analysis - On the Brink of Boring

Investor Psychology - Risk vs Reward

Short-Term Thoughts

Price and Data

The short-term metrics seem to agree with the long-term.

With the completion of every major correction we have seen in 2023, we have seen a move to oversold Daily RSI which is below a value of 30.

We’re not quite there yet, and it seems likely that upon the completion of the correction we will visit that area.

On top of that, there is an obvious support zone highlighted in green which would bottom around $34,000 in March.

Again, every correction that we have seen so far has been inside this support area, even if it was a light retest.

Many different long-term support moving averages and data suggest something similar to what you see here. There is so much debate on what the exact next short-term move is, but I really don't think that’s important in the grand scheme of it all.

The focus remains that there is still some room for downside, however that transpires.

Market Comments

This Time is Different

Never have I seen a group of people more passionate in their belief that Bitcoin cannot correct since the April 2021 cycle top.

In fact, this is the most frequent that I have ever seen the exact words “this time is different” proudly proclaimed in the comment sections.

Why is this happening? Of course because of ETFs.

The assumption is that because of consistent ETF buying pressure, corrections will be shallower.

But many fail to realize that ETFs don’t just offer a buy button, they have a sell button as well.

This means that ETFs are just another method of buying and selling Bitcoin.

Regaurdless, all of these claims come with no proof.

There are no new highs, there is no evidence to show us that 38.5k is the entire extent of the correction we will see.

What we do have, is a plethora of data that calls for lower prices.

Let’s not forget, that the day the ETFs began trading was the exact day of the local high at 49k. People have come up with their own rabbit hole reasons as to why this is the case, but 47- 49k has always been an important level according to data.

Data called for a mid-top, and so far that’s been true.

People will always project what they want to be true for the market, and not what is. Of course, people would want shallower corrections and new ATHs sooner than normal. Haven’t they always?

The reality is, that none of that is here, and we need to work with what we have, not with what we wish.

Higher prices would benefit me. I haven’t sold a penny of any of my holdings.

I am asked oftentimes, why haven’t I sold or shorted? Because the risk is not worth the reward. I would rather wait for the cycle top.

But, I will still guide everyone through the cycles. And sometimes that requires telling people what they don’t want to hear.

Before we continue, I want to give a quick shout-out to my premium newsletter.

I have turned down hundreds of scams, promotions, and affiliates to focus on the only thing that I sell, more information to make sure you’re prepared to make the right long-term buying and selling Bitcoin and Altcoin Decisions.

I have three titles under my belt of doing exactly this. Buying Bitcoin under 10k last cycle, selling everything at 54k in April 2021, and now being all in from 16.5k in Nov 2022.

Not only do you get the most information that you need to succeed from someone who has done it, but also these other benefits:

Private Telegram Group Access

Much longer Bitcoin Newsletters and Exclusive Information

More Videos (Wednesday - Saturday)

Data Library (Beta) Page, CryptoCon’s page for tracking useful data

Dollar Cost Averaging Tools to Scale in and Scale-out of ETH, BTC, and Alts

An Entire Newsletter Dedicated to Altcoins

Premium Charts Page with Live TradingView Charts

Voiceover of Newsletters

Time Sensitive Updates

Full Information on My Long-Term Buy and Sell Decisions

Full Cycle Labs Access

DCA Journey Access (An Account that Follows my DCA Tools)

Altcoin Tracker page to view all of my Altcoin analysis.

Full Models Page Access

+ Even more to come!

I have made sure the value is worth the price. Only more is on the horizon. If you want to make sure you are prepared for the right long-term decisions, you can join us right here:

Long-Term Analysis

On the Brink of Boring

A sideways period is scheduled to begin any moment now according to BitTime, this is standard for Blue Year of every cycle.

Price rallies early on, and then goes sideways for about 4 months into the second early top (purple dot).

Some might say that this sideways period could take place at current prices, and while anything is possible, being only 20% off the mid-top high of 49k does not seem like a likely place for this sideways price action to begin.

Besides what “seems likely”, data says we should expect lower prices.

If you want to argue this time is different without any firm price action evidence… that’s on you… but what we have so far is cycles that are structured and unwavering and that’s what I put my trust in.

Investor Psychology

It’s important to understand risk vs reward. Is the juice worth the squeeze?

This is exactly the reason why I have decided not to sell my holdings even though I believe price is due for further downside.

I must think of taxes, timing the top and bottom, along with other considerations. All of which take potential profits off the table, and add to stress.

On top of this, something in your psychology changes when you do this. It is very important for me to keep my long-term investing mindset far from any short-term thinking. When you make a choice like this, you turn on your short-term brain trying to time local highs and lows.

Part of the reason I have been so successful is because I don’t trade, I wait for cycle extremes (tops and bottoms) to buy and sell. While you could consider this trading, I would term it active investing.

Especially in crypto, it is advantageous to ride the cycle waves as opposed to holding onto your investment forever.

The main reason that people would lose money in the crypto space is because they forget risk/reward, and become short-sighted.

Trading will destroy your mind, and finances.

Consider risk/reward also when you think about buying into Bitcoin.

If you didn’t buy at 16.5k in November 2022, your risk of buying here is significantly higher.

Your main focus as an investor should be to keep your average cost low, and now the risk is in your favor to wait for better prices to buy even if they don’t come.

The masses are experiencing FOMO, thinking that the ETFs will keep price from correcting and it will run off forever without them.

The only thing I can say, is using long-term data from many sources has never let me down, while the thoughts of the masses have, almost every single time.

That’s all for today’s newsletter, I hope you enjoyed! If you did, be sure to leave a like on this post, it helps me out a lot.

I hope you all have an amazing week, and I will see you next time!

Best wishes,

CryptoCon

Love your thought process for the analysis. Wondering if you do the same cycle analysis for other areas like stocks? Would be interested in hearing your views on things like commoditiy cycle timing to help find lows.

I love that it reads the article while I’m on the go..

Good info… thx