There's Still Room!

Bitcoin Data Newsletter

Hello Everyone!

In the last newsletter, we discussed the upcoming New Year’s Bitcoin Party as November 28th began Blue Year.

The beginning of Blue Year is typically great for price, and so far that has continued to be true!

For the short term, I showed you that there were big short liquidation levels above 38.5k:

Of course, price blasted through that and then some, reaching almost $45,000 at its peak.

In our long-term observation, I talked about the Magic Bands still calling for that 48k price mark at level 2.

We have made some progress toward that, but are still just shy of hitting it.

In yesterday’s premium newsletter, I talked about the topic “Was That It?” You can visit that article to see my full thoughts on the current state of the cycle mid-top.

The question I’ll be seeking to answer for you is, how much gas is left in this rally, if any?

Be sure to stick around to the end to read an important investor psychology piece, “The Herd”. Are you unknowingly a part of it?

Spirits are tanked on the latest 10% drop. Let’s see what the data has to say!

This Newsletter Will Cover….

Short-Term Thoughts - Building Blocks

Market Comments - There is No Consensus

Long-Term Analysis - It’s All Relative

Investor Psychology - The Herd

Short-Term Thoughts

Building Blocks

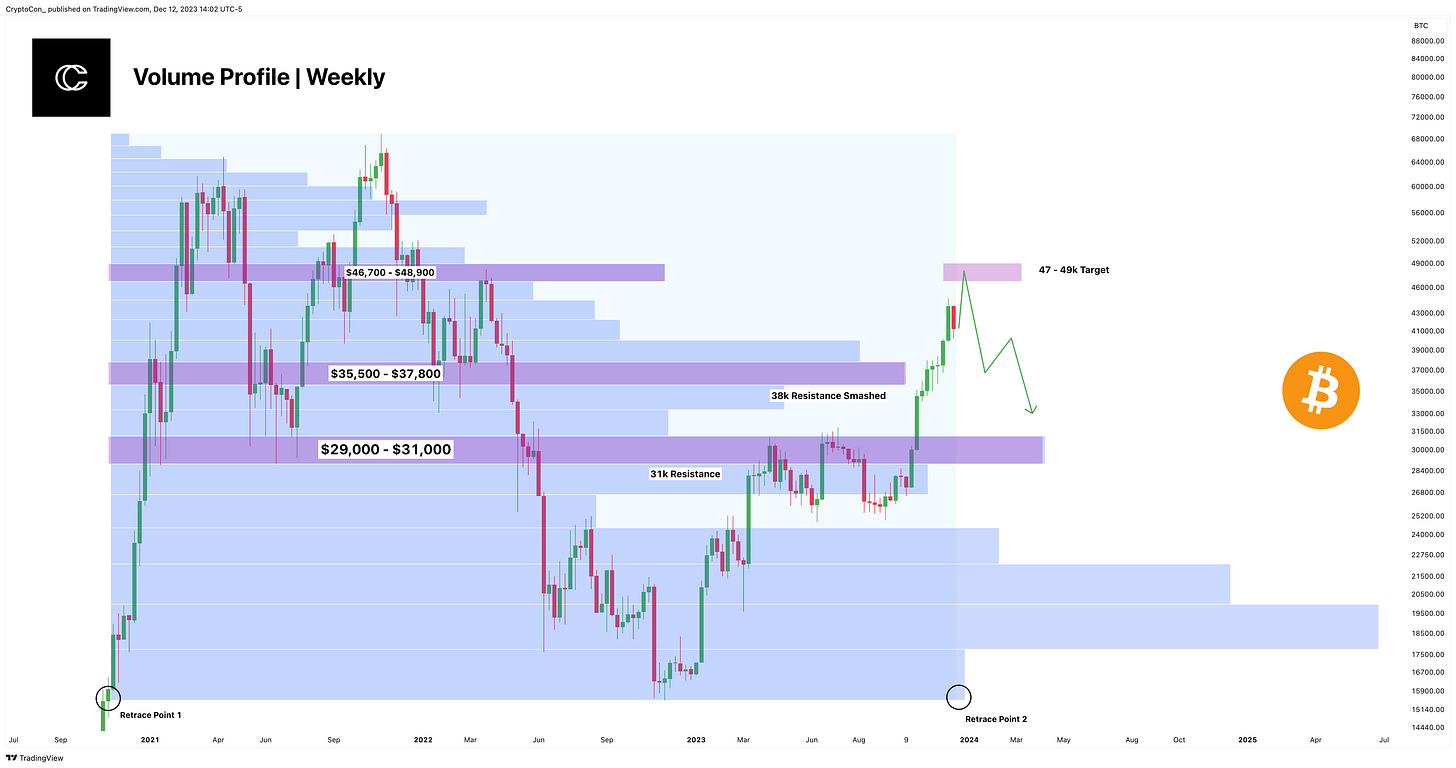

It’s been a while since I whipped out the volume profile!

This metric allows us to view volume on a horizontal scale to construct support and resistance zones.

The larger the amount of volume traded in an area, the stronger the support or resistance.

To illustrate just how powerful these resistances can be, price spent a whopping 8 months sideways underneath the 31k block.

38k was a similar level of resistance, and not a single Weekly red candle was seen during that time. Our current move is incredibly strong.

Price has now formed support on top of a larger block of volume, priced around 40k.

Take note though where our next area of resistance is… $46,000 - $48,900.

I don’t think the relatively small bit of downside we’ve seen recently counteracts that target.

It’s not just there, we see this price range, it’s everywhere on the charts, from Fibonacci ratios and everything in between.

Are a lot of people expecting these prices? You bet. But a lot of people were also expecting us to top out lower, or here, or higher than 48k.

The only thing I believe that matters is what data tells us, and we will get to that in our long-term analysis portion.

For now, higher targets still loom.

Market Comments

There is no Consensus

To be honest, I haven’t been looking to see what others are saying in our space much. I have taken only a couple of strolls through the community to see the general thought.

In times like these, when I believe we approaching an important mid-cycle point, I prefer to keep my head clear and focus only on the charts.

It would be easy to get wrapped up in the greedy thoughts of ETF money flowing into the space, or fear bias that comes after a 10% drop from other analysts.

I have kept my mind honed with data, and nothing else.

The two biggest comments I get are “But everyone’s expecting 48k” and “What about the power of institutional inflows with ETFs”.

I’m surprised by the ETF comments… I figured I had made it abundantly clear.

Essentially, I really don’t care about the ETFs. You are anticipating a news event, the same as if you were a recession anticipator at 25k, only…. the bullish version of that.

As I stated earlier about people expecting 48k, they have the right to! And I should tell you also, it is not even close to unanimous.

This is especially true after the last drop. I have done some more rounds and it seems that X has gone pretty quiet.

In my opinion, most people are unsure and hedging their bets.

I am taking the risk to say that Bitcoin has not topped out yet, because no long-term data has said so.

You can see one example of that here in this post.

The price isn’t the thing… I’m more than happy to say that the mid-top could be in at any price, so long as the data suggests it.

I will continue to be patient, and if that is patently wrong, then that’s okay. We can adjust afterward.

But for now, I continue to trust that long-term data will remain consistent as it has for all previous cycles.

Before we continue, I want to give a quick shout-out to my premium newsletter.

I have turned down hundreds of scams, promotions, and affiliates to focus on the only thing that I sell, more information to make sure you’re prepared to make the right long-term buying and selling Bitcoin and Altcoin Decisions.

I have three titles under my belt of doing exactly this. Buying Bitcoin under 10k last cycle, selling everything at 54k in April 2021, and now being all in from 16.5k in Nov 2022.

Not only do you get the most information that you need to succeed from someone who has done it, but also these other benefits:

Private Telegram Group Access

Much longer Bitcoin Newsletters and Exclusive Information

More Videos (Wednesday - Saturday)

Data Library (Beta) Page, CryptoCon’s page for tracking useful data

Dollar Cost Averaging Tools to Scale in and Scale-out of ETH, BTC, and Alts

An Entire Newsletter Dedicated to Altcoins

Premium Charts Page with Live TradingView Charts

Voiceover of Newsletters

Time Sensitive Updates

Full Information on My Long-Term Buy and Sell Decisions

Full Cycle Labs Access

DCA Journey Access (An Account that Follows my DCA Tools)

Altcoin Tracker page to view all of my Altcoin analysis.

Full Models Page Access

+ Even more to come!

I have made sure the value is worth the price. Only more is on the horizon. If you want to make sure you are prepared for the right long-term decisions, you can join us right here:

Long-Term Analysis

It’s All Relative

Almost all of the data I watch for the cycle mid-top is on a horizontal measure, but this one breaks that trend.

This is Relative Unrealized Profit, an indicator that will likely be very useful as well in determining the true cycle top.

This metric measures how much paper profit investors are in, but also factors in previous price action. This makes it so the metric is less susceptible to the “diminishing effect” that you might see on many indicators where each cycle top comes lower than the last.

The mid-tops have so far always increased along the trend. This is shown by the red line.

The trigger for the mid-top to occur is a break above the black line, which has just happened.

It may seem like there is a lot of room before reaching the channel top here, but keep in mind that this metric is relative, so it is now much easier to get there than it would be for a previous cycle.

The first break (red circle) has always taken us to the red line.

For price to stop here, it would cause a “this time is different” on data across the board.

The relative unrealized profit is just another piece of evidence to add to the bag for “we’re not quite there yet”.

Investor Psychology

The Herd

The Bitcoin Herd feels like good company, that’s why it’s so easy to stay there.

Most people don’t know they’re part of it.

It is an unfortunate side effect of any market, especially crypto.

For you to make gains here, sheep will have to be led to the slaughter. I have talked to so many people who were hurt from the last cycle, and they won’t let it happen again.

And that’s what powers it. For all of those who were buying at the top last cycle in hopes of 100k, there was a select few on the other side who profited off those mistakes.

How do know which camp you are in? It is simple.

Stories and facts. It all comes down to this.

I am amazed at how much I heard the same regurgitated stories at critical points.

At 25k, it was “Have you considered the possibility of 20k, how about 15k? What if Blackrock is trying to get in at lower prices? Don’t you know a recession is coming?”

You might think this sounds silly but I get many people who were dead serious.

They wrap themselves in fear, in news stories… an elaborate made-up scenario in which someone is always out to get them.

And now? It’s completely flipped.

“Don’t you understand that BlackRock is about to pour billions of dollars into Bitcoin? You really just don’t get it do you?”

If this is you, don’t worry, I see you. You have subscribed to the herd.

Institutions will not pour billions of dollars into Bitcoin all at once and make you rich. Truly, they probably won’t do it noticeably enough over time to make that big of a difference either!

It’s such a silly thought, driven by greed.

It is absolutely no different than recession callers. You are an ETF caller.

Your thoughts are based on stories, not facts. The masses believe ETFs will make them rich. The cycles are in control.

Data tells us when to act, and if you can base all of your ideas on reliable long-term data from a multitude of sources and nothing else, then congratulations! You just started thinking for yourself.

I am here to help you. After both experiencing and making the right choices at cycle tops and bottoms, I can tell you that stories will absolutely ruin you.

The correct mentality is to always focus on the data, and let the news play itself out. Never try to anticipate it.

This time is not different. It is always similar, always rhyming.

That’s all for today’s newsletter, I hope you enjoyed! If you did, be sure to leave a like on this post, it helps me out a lot.

I hope you all have an amazing week, and I will see you next time!

Best wishes,

CryptoCon

Great piece of work! Thx for sharing. 🙏🏼

Brilliant write-up!!! At least my mindset is out of sheep herd mentality after reading Cc's Newsletter... Now, I have clear direction what I have to do protect my investments. I love the Cc's data analysis and keeping us ten steps ahead....