The Power of Speculation

Bitcoin Data Newsletter

Hello Everyone!

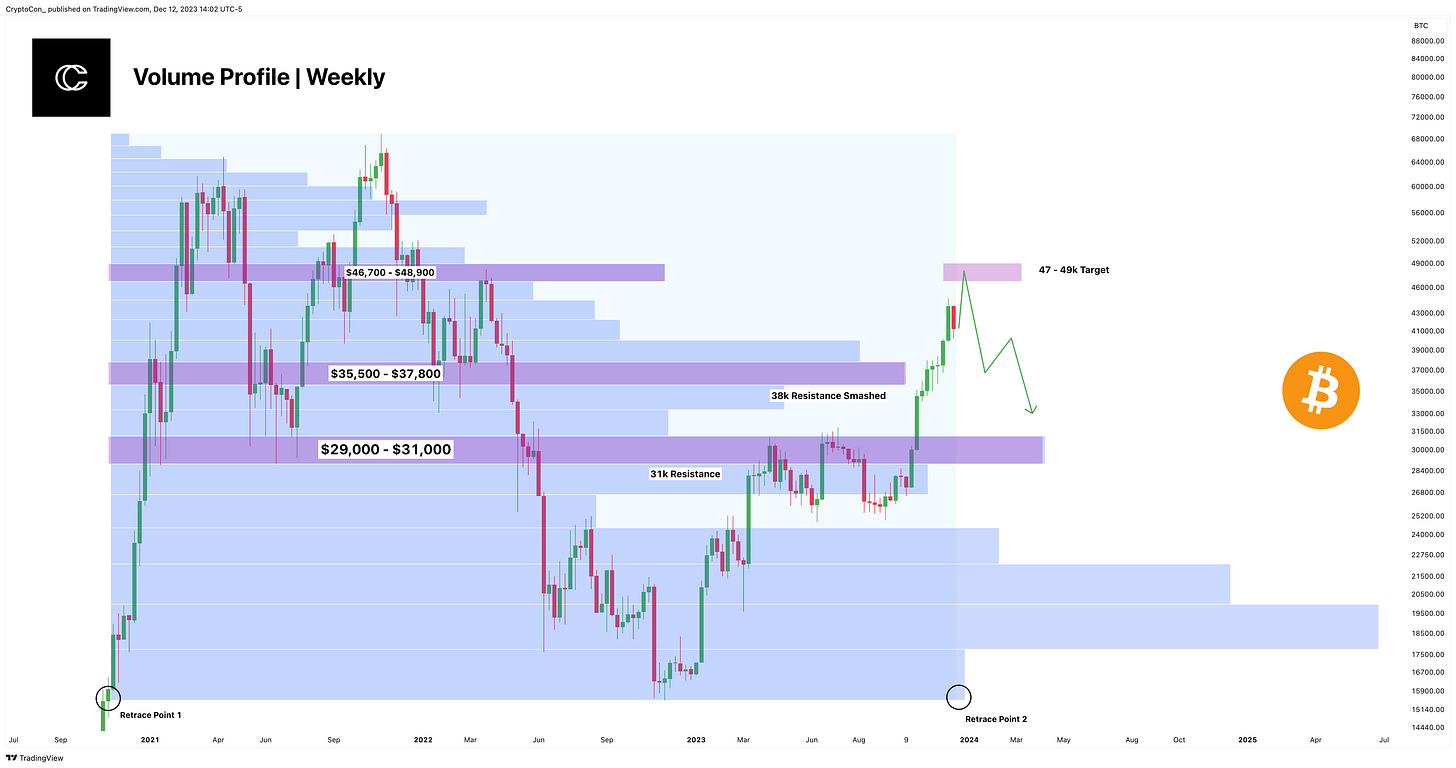

In the last Bitcoin Data Newsletter, I talked about how I believed there was room for growth beyond 45k, and prices like 48k were still on the table:

Since then, I decided to shift my perspective to favor that Bitcoin may be overheated for the short-term, and topped out at 45k.

The idea is that since a majority of data had called for a mid-top, it was best to respect it and not wait for the stars to align.

Through the power of speculation surrounding ETFs, Bitcoin has wound up right back at step 1, surmounting 45k and now breaching 47k.

Because of this, it has now become reasonable to expect all data to reach its cycle mid-top points, no matter how common the expectation.

Potential ETF approvals are looming, and no one knows what will happen next.

While many are waiting on the institutions to bring the big price action, I believe the factor that will have the most impact is the speculation of retail, in whichever direction that chooses to go.

In today’s newsletter, we’ll be looking at the short and long-term, I’ll talk about my comments on the market, and then conclude with a piece of investor psychology:

Rationale in a Sea of Emotion.

This is more important now than ever before.

Let’s get started!

This Newsletter Will Cover….

Short-Term Thoughts - Relentless shorts

Market Comments - Speculation

Long-Term Analysis - Data is still my compass

Investor Psychology - Rationale in a Sea of Emotion

Short-Term Thoughts

Relentless shorts

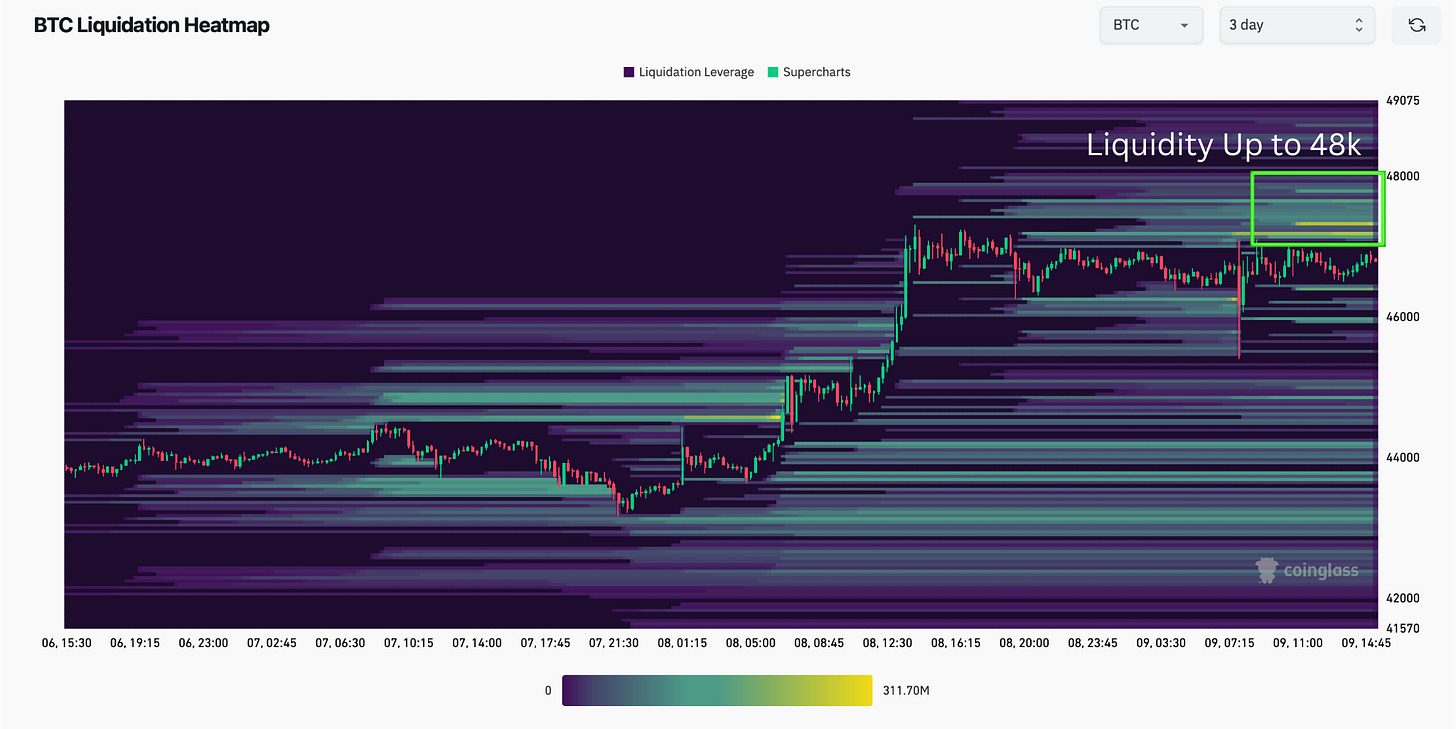

Although data was suggesting overheated prices at 45k, one of my biggest bullish counter-arguments was the liquidation heatmap which I talked about in many of my premium videos.

The short liquidation continues to be stacked to the upside, and I have watched this metric nail movement after movement time and time again.

The areas of densest, brightest color represent predicted high levels of liquidation and often act as a magnet for price action.

The shorters have been relentless, and here again, we see on the 3-day time frame that most of the liquidity lies above, again suggesting we may see another push higher.

The majority of the liquidity stops at around 48k, which is a very popular price target amongst analysts, and previously myself.

I am not calling for a specific price target for now and remaining open to multiple possibilities. This is in preparation for whatever decides to come of the ETF news event soon and to focus on data rather than price targets.

As I’ve shown in today’s and yesterday’s X posts, some data has not triggered and it now seems likely that it will since price has decided to continue.

Market Comments

Speculation

I believe that in normal circumstances, the data that had already triggered may have called for a top at 45k.

Some people may interpret this as “Right! This time is different because institutions are about to dump billions into Bitcoin”.

That’s not what I’m saying at all.

The thing that I believe is not normal is the speculation. Positive news events have a history of coming around local tops for Bitcoin, the launch of CME futures, and the Coinbase IPO.

But the ETF has always been the holy grail of bullish Bitcoin news events, I remember even when people were hoping for it last cycle.

And now we have a supposed expected date for the event. I have heard January 10th which is tomorrow.

It’s not the actual event that I think is powerful, but the idea that people have in their mind that is powerful.

If many are thinking that they should buy some Bitcoin in preparation for a supposed unprecedented bullish event, that would cause price to rise.

But what happens if institutions don’t dump billions of dollars into Bitcoin all at once, because the people that would be purchasing through them would want good buying prices just like you and me?

I’m not claiming to know what will come of the event, in fact, I’m clearly stating I have no idea.

I think the best option is just to be present for the moment, ideally holding onto your coins.

Although I have said that Bitcoin may be topped out short-term at 45k, I have never suggested that selling was the right choice. There are many risks involved in doing so and I have held onto my entire portfolio.

As always, it is best to adopt the mentality of “nothing is different until price proves that it is”, this goes into logical thinking, which we will talk about later.

Before we continue, I want to give a quick shout-out to my premium newsletter.

I have turned down hundreds of scams, promotions, and affiliates to focus on the only thing that I sell, more information to make sure you’re prepared to make the right long-term buying and selling Bitcoin and Altcoin Decisions.

I have three titles under my belt of doing exactly this. Buying Bitcoin under 10k last cycle, selling everything at 54k in April 2021, and now being all in from 16.5k in Nov 2022.

Not only do you get the most information that you need to succeed from someone who has done it, but also these other benefits:

Private Telegram Group Access

Much longer Bitcoin Newsletters and Exclusive Information

More Videos (Wednesday - Saturday)

Data Library (Beta) Page, CryptoCon’s page for tracking useful data

Dollar Cost Averaging Tools to Scale in and Scale-out of ETH, BTC, and Alts

An Entire Newsletter Dedicated to Altcoins

Premium Charts Page with Live TradingView Charts

Voiceover of Newsletters

Time Sensitive Updates

Full Information on My Long-Term Buy and Sell Decisions

Full Cycle Labs Access

DCA Journey Access (An Account that Follows my DCA Tools)

Altcoin Tracker page to view all of my Altcoin analysis.

Full Models Page Access

+ Even more to come!

I have made sure the value is worth the price. Only more is on the horizon. If you want to make sure you are prepared for the right long-term decisions, you can join us right here:

Let’s get into our long-term analysis!

Long-Term Analysis

Data is still my compass

While this time overall is still not different, there is one thing that has been and that is time frames to achieve the mid-top after data trigger.

Here I have displayed the NUPL when it visits the green belief denial zone for the first time in the cycle, the mid-top has always been in, in less than 2 weeks.

This happened at 45k, which is one of the many pieces that led me to the 45k local high conclusion.

Over 1 month after the fact, price continues to rise.

The reason?

I believe speculation.

We can see that data remains overheated, but price is continuing.

Typically, after mid-top signals have triggered, there is usually about one more substantial rise which ends the mid-top. We did not see that after 45k, but it appears we are now.

I believe that we will now need to watch for data like the MVRV, and the 2-week fisher transform which I have mentioned on X reach their points before price stops.

We also still have some time left for speculation surrounding ETFs, which we have already seen what that can do.

For now, we should acknowledge that most data remains overheated but also prepare for addtional speculative upside in combination with the room that other data that has not reached their mid-top points, leaves on the table.

Eventually, I am still convinced a sizeable correction in the 30% range is due. Bringing prices like the low 30k’s.

Investor Psychology

Rationale in a Sea of Emotion

There is a critical lack of true logical rationale in the crypto space.

People are highly influenced by their emotions, and you should thank them! That is the very thing that allows you and I to profit.

Whatever direction people believe price will go, investors are angry. Comments sections are littered with hate and animosity.

The data has always been reliable for me, in one way or another. People are quick to disregard it when it suits them. I believe it dispels myths and truths.

Some argue that looking to the long-term data for guidance instead of trusting the fundamental power of ETFs, is foolish, but let me say that I have seen data win again and again. What I have never seen win… is speculation.

In the long run, trusting in unforeseen events has always led to nothing.

Most times, it is always the speculation of the event that causes the most damage. A potential recession, exchange, or banks collapses, you name it.

It is important to remember that what we are doing here is playing a game.

In the end, 90% of us want to buy at the best prices possible, so we can ride the rocket as far as possible, and then get rid of our coins for a profit.

Someone must suffer on the other end in order to do this.

I was fortunate enough to have bought all of my Bitcoin at 16.5k this cycle, which I still hold on to.

In that moment, some people somewhere sold that Bitcoin to me, almost assuredly at a loss.

When I go to sell those Bitcoin, someone will buy them from me. Assuming data proves accurate once again they will probably hold those coins at a loss.

Never believe the lie that we can all win together, which is perpetuated by the space.

They will make you think that ETFs are a win for everyone. People will blindly pile billions in to make you rich.

“If it sounds too good to be true… it probably is.”

Never underestimate your opponents, and your opponents, are everyone.

I urge you to find grounding in the rationale of data, and not hopes and dreams.

I want you all to be as successful as possible, and this mentality has done well for me.

That’s all for today’s newsletter, I hope you enjoyed! If you did, be sure to leave a like on this post, it helps me out a lot.

I hope you all have an amazing week, and I will see you next time!

Best wishes,

CryptoCon

Great as always. Sorry I got upset about my sell of gbtc my own fault. You do a superb job and I respect everything you do. You sound like a good and humble man. My apologies from yesterday

I will make it back I am sure of it with your help. God bless kim b

man.. you should be a motivational speaker 100%. WTF hahahah.. great stuff man.