Hello Everyone!

Bitcoin is exploding in value at now new ATHs of 73.7k.

In the last Bitcoin Data Newsletter, I talked about how data remained overheated, while price continued to climb.

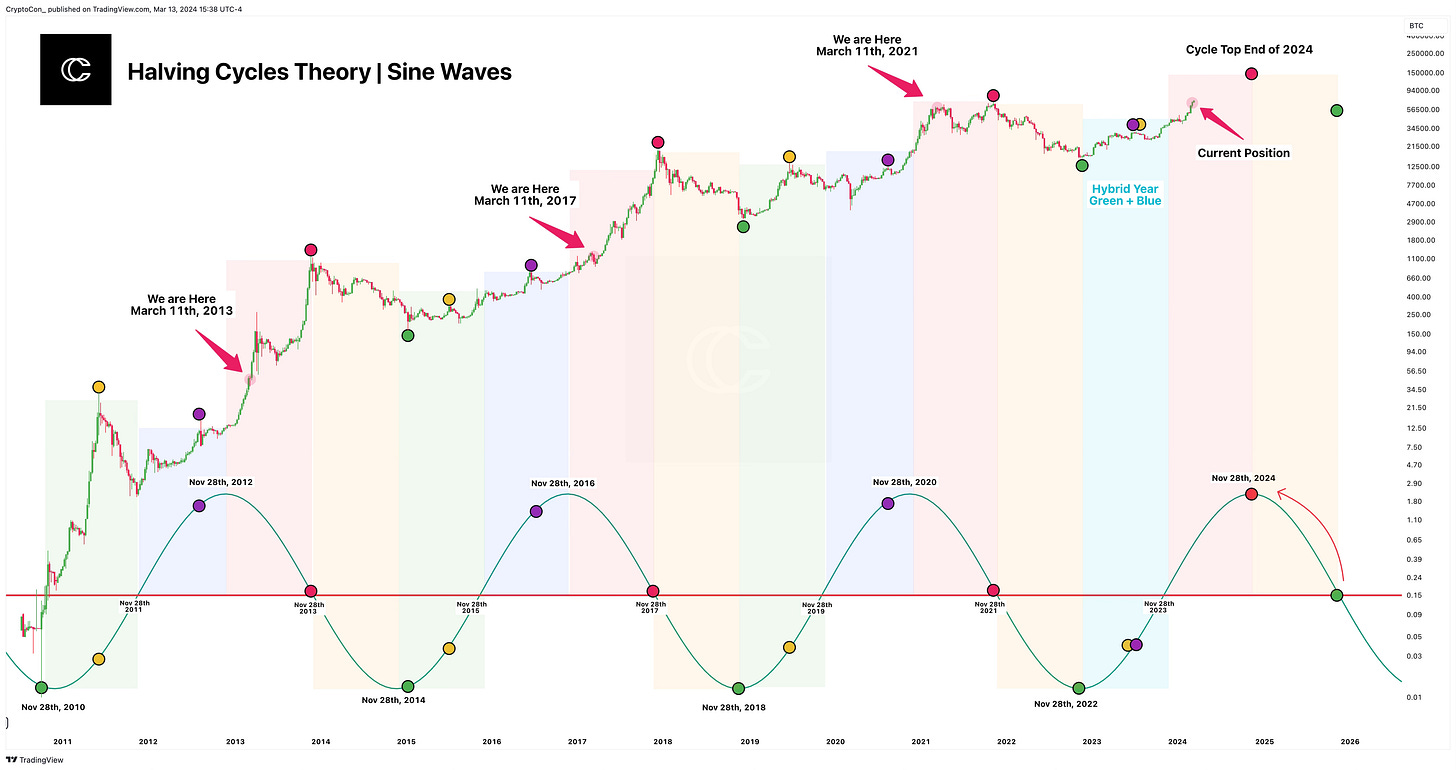

I remained flexible to all short-term possibilities with the potential to completely change my views on cycle timing which was a cycle top in late 2025.

I’ve now shown that I believe the cycles could be 1 year accelerated, bringing us a top later this year.

This leads some to question why we couldn’t just see a top in late 2025 as usual but with higher prices because of ETFs throwing the wind at our backs.

That’s the topic of today’s newsletter, then Long-Term Holder Exodus.

On-chain data confirms what the price action is telling us, it is getting overheated, and long-term holders are leaving.

I’ll be covering two long-term analysis pieces today, alongside my market comments and important investor psychology topic on narratives.

Let’s dive in!

This Newsletter Will Cover….

First Long-Term Analysis - Long Term Stashes

Market Comments - Getting Used to Greed

Second Long-Term Analysis - Smart Investors

Investor Psychology - Dangerous Narratives

First Long-Term Analysis

Long-Term Stashes

In early February this year, I shared this chart which shows the amount of Bitcoin that has gone 2 - 3 years without moving.

You can see that in this X post.

When Bitcoin is accelerating into the cycle top, and especially for the last 2 cycles, we have seen a pinnacle and major decline in this holder group.

The large surges up in the data imply that many more coins have not moved for 2 -3 years. But downturns imply that these older coins are on the move again.

Once the first major downturn is complete, it has been about 1 year to the cycle top, with the first cycle being 1 year 6 months.

This would line up perfectly with a top later this year.

Many wrote this data off as coincidental, but this doesn’t seem like any accident. Older coins are on the move, I believe heading to exchanges to be sold.

The downturn is now even more undeniable. The clock is ticking.

Market Comments

Getting Used to Greed

Past ATHs, we start to enter interesting territory. You’re going to see greed and a lot of it.

It can carry on for illogical amounts of time.

My comment sections are filled with people telling me data is broken, and it doesn’t work anymore because of ETF buying pressure.

And as long as Bitcoin continues to rise, they will appear to be right.

When others are greedy, I become fearful. I have been searching the data far and wide, fortunately, I see no evidence of a cycle top yet.

The crypto space will get even more ridiculous once Altcoins truly start to take off. This is typically the case some weeks after Bitcoin makes new ATHs.

There are a few key things I remember from the height of the last crypto market.

My friends who had no interest in the coins at low prices (6k in 2020) were now starting to buy in

Almost everyone I knew started putting money into crypto

A family member called out of the blue wondering if they should invest

Almost no one in the crypto space considered 64k could be a top

Almost everyone was waiting on a single price target (100k)

Influencers abroad guaranteed extreme price targets, encouraging people to buy every dip even close to the top

Many people thought there may be no bear market then as well because of institutional buying

We will talk more about this when we get to narratives in our investor psychology section, but our space is not one that makes money forever.

Why do people love it? Because it offers higher returns than anywhere else. Eventually, that comes to an end. Hence, how the cycles repeat.

The cycles have accelerated to new ATHs, for a while we can kick back and enjoy the rise!

Before we continue, I want to give a quick shout-out to my premium newsletter.

I have turned down hundreds of scams, promotions, and affiliates to focus on the only thing that I sell, more information to make sure you’re prepared to make the right long-term buying and selling Bitcoin and Altcoin Decisions.

I have three titles under my belt of doing exactly this. Buying Bitcoin under 10k last cycle, selling everything at 54k in April 2021, and now being all in from 16.5k in Nov 2022.

Not only do you get the most information that you need to succeed from someone who has done it, but also these other benefits:

Private Telegram Group Access

Much longer Bitcoin Newsletters and Exclusive Information

More Videos (Wednesday - Saturday)

Data Library (Beta) Page, CryptoCon’s page for tracking useful data

Dollar Cost Averaging Tools to Scale in and Scale-out of ETH, BTC, and Alts

An Entire Newsletter Dedicated to Altcoins

Premium Charts Page with Live TradingView Charts

Time Sensitive Updates

Full Information on My Long-Term Buy and Sell Decisions

Full Cycle Labs Access

Altcoin Tracker page to view all of my Altcoin analysis.

Full Models Page Access

+ Even more to come!

I have made sure the value is worth the price. Only more is on the horizon. If you want to make sure you are prepared for the right long-term decisions, you can join us right here:

Second Long-Term Analysis

Smart Investors

I have previously referred to the fish, which are holders that have between 10 - 100 Bitcoin, as the smart investors.

You will notice the large increases in these groups of holders during bottoms and decreases during parabolic rallies.

This metric continues to plummet, showing that this group of holders may be leaving the market. There is also the possibility that this is a wallet shuffle, but regardless it has been a very effective metric in the last 2 cycles.

With the large decrease, you might say that these holders aren’t “smart” if we have seen them decrease since 28k, but look at it as a leading indicator.

These holders aren’t declining for no reason, and I believe it amplifies our need to pay attention.

The smart investors are amid their exodus.

Investor Psychology

Dangerous Narratives

Narratives, or stories.

Time after time I have seen it crush opportunity. In fact, it has been the biggest reason why investors don’t buy or sell at the right times.

You have trouble remembering them because it all seems so obvious in hindsight, but during the event, it keeps you completely blind.

Let’s take a trip down memory lane.

The 2020 COVID black swan. Of course, the market would recover, you think as you look back. But in that exact moment when Bitcoin dropped below 4k everything was completely uncertain.

There were predictions of 1k then, which were extremely popular. Besides stock-to-flow, which just sounded like a hope and a dream then, there were almost no expectations of an upcoming bull market.

Psychology flipped back to greed after 20k in December 2020. Stock-to-flow was the prevailing idea and narrative, paired with a seemingly guaranteed price target of 100k.

People may forget this because everything has now been justified. “That model wasn’t the original.” The original model was never mentioned then.

100k was bearish. S2FX called for 250k, which was the primary idea.

Institutions like Tesla started to buy Bitcoin, people genuinely believed there would be no bear market, no cycle top. Suggesting a cycle top below 100k was unheard of.

Everyone thought they would win, chanting the same thing as everyone else. 100k, stock-to-flow. Almost everyone believed it.

But, the cycles continued as usual, and Bitcoin topped according to Data in April 2021, and then again barely higher in November 2021.

People are now rectifying this by saying it was manipulated to be lower. This benefits no one. Everyone benefits from the market continuing to go higher, even those who would want to manipulate.

During the bear market lows, the narrative became a recession. This carried on throughout early 2023. During 16.5k, and any dip thereafter, people told us that a recession would take us to 16.5k again or lower.

People wholeheartedly believed it.

I was approached by countless “experts” in my comment sections, telling me that I didn’t understand the macro, a recession and a return to the lows was inevitable.

Multiple times influences prepared you for a potential black swan, of course, that never came because black swans are unpredictable.

Now ETFs are here, and people are using them to buy.

People think, now that ETFs are here there will be no bear markets and we will rise into infinity forever! Sound familiar? You know investors can eventually sell through ETFs too right?

The narrative is convincing, and most people will believe it. Just like they believed the world was over in March 2020, just like they believed in 100k stock-to-flow, just like they believed in the inevitable recession that never came.

The geniuses are out again to tell you how dumb you are to not believe the same thing everyone else does, and I can’t wait until the time comes that I sell my coins to them!

Bitcoin is not the stock market, returns come much more rapidly. Once the scales start to tip too heavily in the holder’s favor, they become anxious to secure their profit, selling ensues, the market corrects, balance is restored, and the cycle repeats.

That’s all for today’s newsletter, I hope you enjoyed! If you did, be sure to leave a like on this post, it helps me out a lot.

I hope you all have an amazing week, and I will see you next time!

Best wishes,

CryptoCon

Thanks so much for the great analyses!

CC,

Much of what you write makes sense.

However the ETF’s are having inflows of a billion dollars each and every day, and the advisors don’t even have it on their platforms yet.

FASB hasn’t kicked in for many of the public companies as of yet, and more.

Won’t this impact the price, not only to the upside, but also IF this amount of inflows continue, that the extreme decline in a bear market (80%), MAY not happen again?

Cheers!