Overheated, and Climbing

Bitcoin Data Newsletter

Hello Everyone!

It’s been an interesting couple of weeks, with Bitcoin having now blasted to prices near 53k.

I would claim, that it is against the odds.

Data sounded early signals of an impending mid-top at 45k, and all price points were met at 49k.

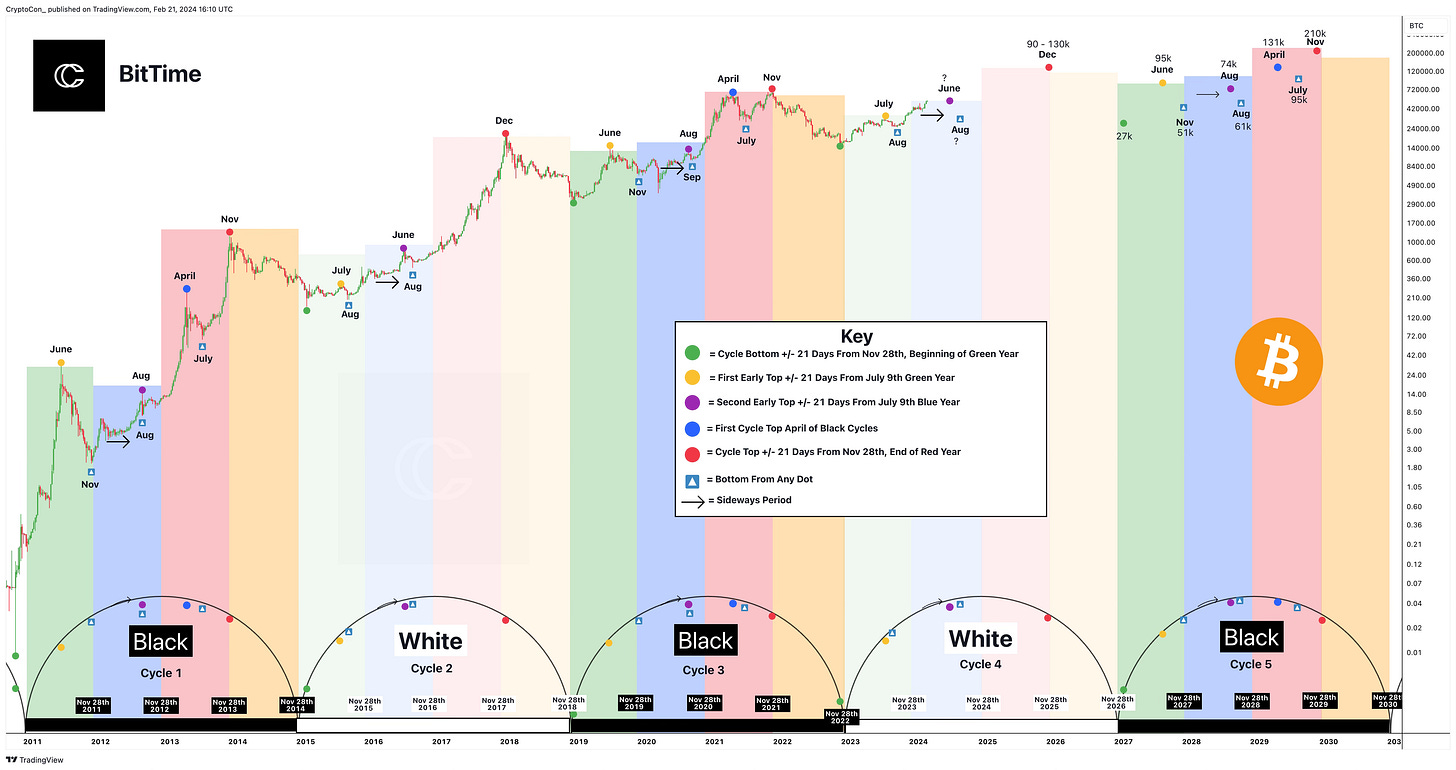

On top of this, a BitTime sideways period is scheduled to begin any moment:

This is designated by the black arrows.

The rally we’ve seen has been nothing short of impressive. Is this because of addtional buying pressure coming from ETFs? I’m no fuddy-duddy, so I am remaining open to the idea.

I have always been a big advocate for data, but there is one thing that reigns king over that: price.

We’ll be talking about this, and my other thoughts about the market alongside some short and long-term data coverage as usual.

We’ll wrap up by talking about an important psychological point: being alone.

As a successful investor, you will almost always be just that, alone.

Let’s get started!

This Newsletter Will Cover….

Short-Term Thoughts - Low Volume, High Attraction

Market Comments- Extreme Greed

Long-Term Analysis - The Last Bits

Investor Psychology - The Lone Wolf

Short-Term Thoughts

Low Volume, High Attraction

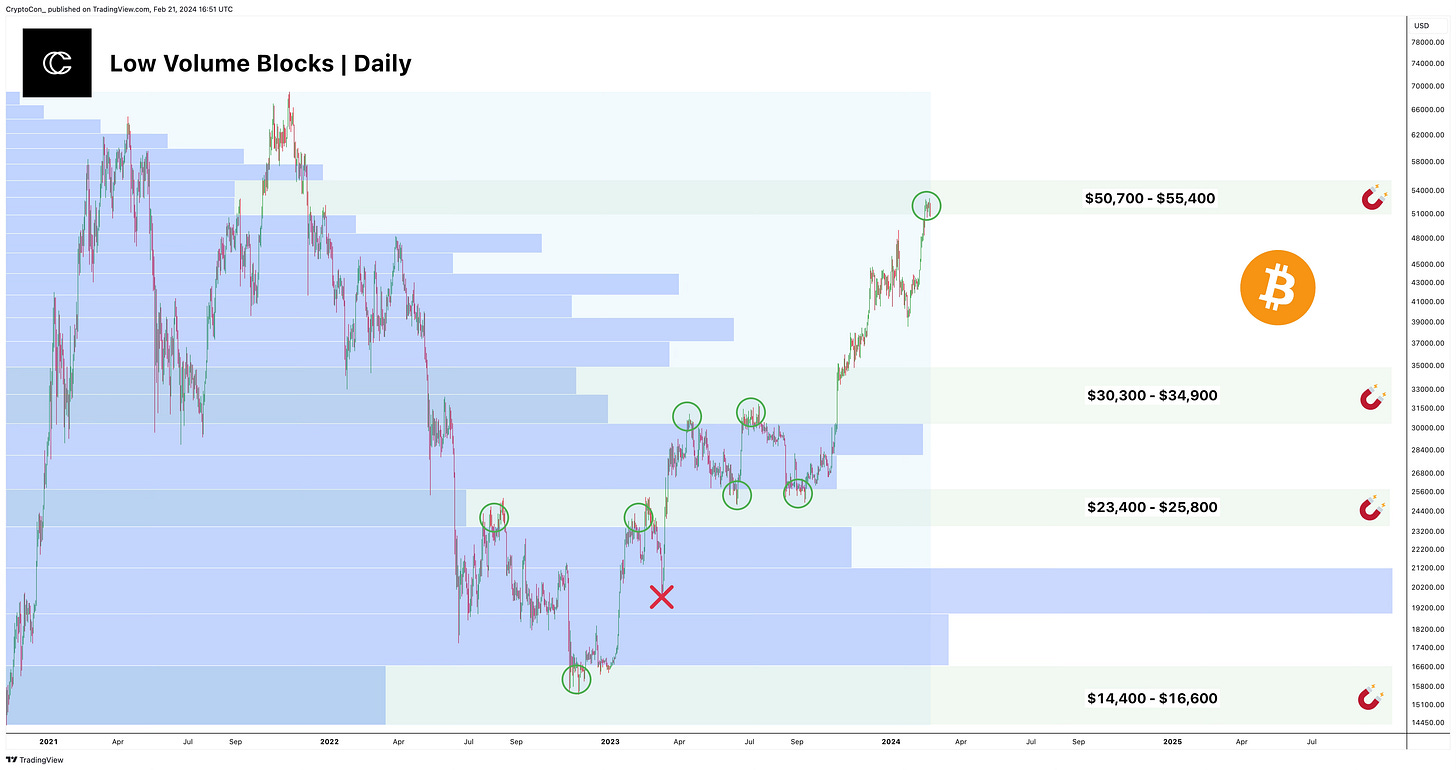

Many times even more frequently than the large blocks of volume, it seems that price gravitates towards large areas of low volume.

Of all the examples I have shown for the mid-cycle, only one (designated by the red X) was not in an area of low volume.

It’s almost as if you can see the stop-loss hunting in action here, with price just barely scraping into the low-volume areas before reversing.

There have been several low-volume points up to 53k, but none like we have seen here.

This is the first large block of low volume since prices of 30.3k to 34.9k.

Notice that I have no path drawn here as to where I think price goes next. This plays into the theme of today’s newsletter: “Overheated and Climbing”.

Logically, this is a great place for price to turn around according to the Volume Profile. Long-term data remains overheated as well. So then the question remains, can price continue to climb against the odds? I am waiting to see.

Market Comments

Extreme Greed

The market has been extremely greedy, and that’s not just my opinion, the data shows this as well:

Fear and Greed is 78/100, or extreme greed. These are amongst the highest ratings we have seen since the 2021 cycle top.

From the little data we have, we see that extreme greed can carry on for a long time in the context of a parabola, but our current move can’t be defined as that just yet.

There have been more people using the exact words “this time is different” in the comment sections than I have ever seen before.

If an analyst proposes that price may correct, they are attacked into oblivion. The bulls are wildly angry.

I am hoping that price corrects as data and cycle timing suggests it should, to bring balance back to the market.

I want the cycles to remain on track. The longer price takes to reach its destination, the higher it can go. A short parabolic burst will likely end much shallower than many are expecting.

There are many on the sidelines hoping for a place to scale in. Even though I am fully invested, and will not be buying any more Bitcoin this cycle, I want that opportunity to come for them.

Data hasn’t budged, the low 30k target that I proposed is still out in the open, with higher supports in the low 40ks.

The greed-filled masses will not win at the cycle top. That emotion will keep them holding on, until the next cycle bottom.

When data guided me to sell at 54k after the 64k April 2021 top, people used those same words “This time is different”. They told me how stupid I was for selling with the power of institutions buying.

Taking profit is never stupid, in fact, it is my one and only goal.

As we will talk about in a moment, you will often be alone in your ideas when the time comes to make the right decision.

Before we continue, I want to give a quick shout-out to my premium newsletter.

I have turned down hundreds of scams, promotions, and affiliates to focus on the only thing that I sell, more information to make sure you’re prepared to make the right long-term buying and selling Bitcoin and Altcoin Decisions.

I have three titles under my belt of doing exactly this. Buying Bitcoin under 10k last cycle, selling everything at 54k in April 2021, and now being all in from 16.5k in Nov 2022.

Not only do you get the most information that you need to succeed from someone who has done it, but also these other benefits:

Private Telegram Group Access

Much longer Bitcoin Newsletters and Exclusive Information

More Videos (Wednesday - Saturday)

Data Library (Beta) Page, CryptoCon’s page for tracking useful data

Dollar Cost Averaging Tools to Scale in and Scale-out of ETH, BTC, and Alts

An Entire Newsletter Dedicated to Altcoins

Premium Charts Page with Live TradingView Charts

Voiceover of Newsletters

Time Sensitive Updates

Full Information on My Long-Term Buy and Sell Decisions

Full Cycle Labs Access

DCA Journey Access (An Account that Follows my DCA Tools)

Altcoin Tracker page to view all of my Altcoin analysis.

Full Models Page Access

+ Even more to come!

I have made sure the value is worth the price. Only more is on the horizon. If you want to make sure you are prepared for the right long-term decisions, you can join us right here:

Long-Term Analysis

The Last Bits

Most Mid-Top data fired early signals at 45k. The price points like the .618 cycle retrace were then met after 49k.

But a few, very accurate data points were left uncompleted. This included metrics like the MVRV-Z Score and the Weekly Chaikin Money Flow.

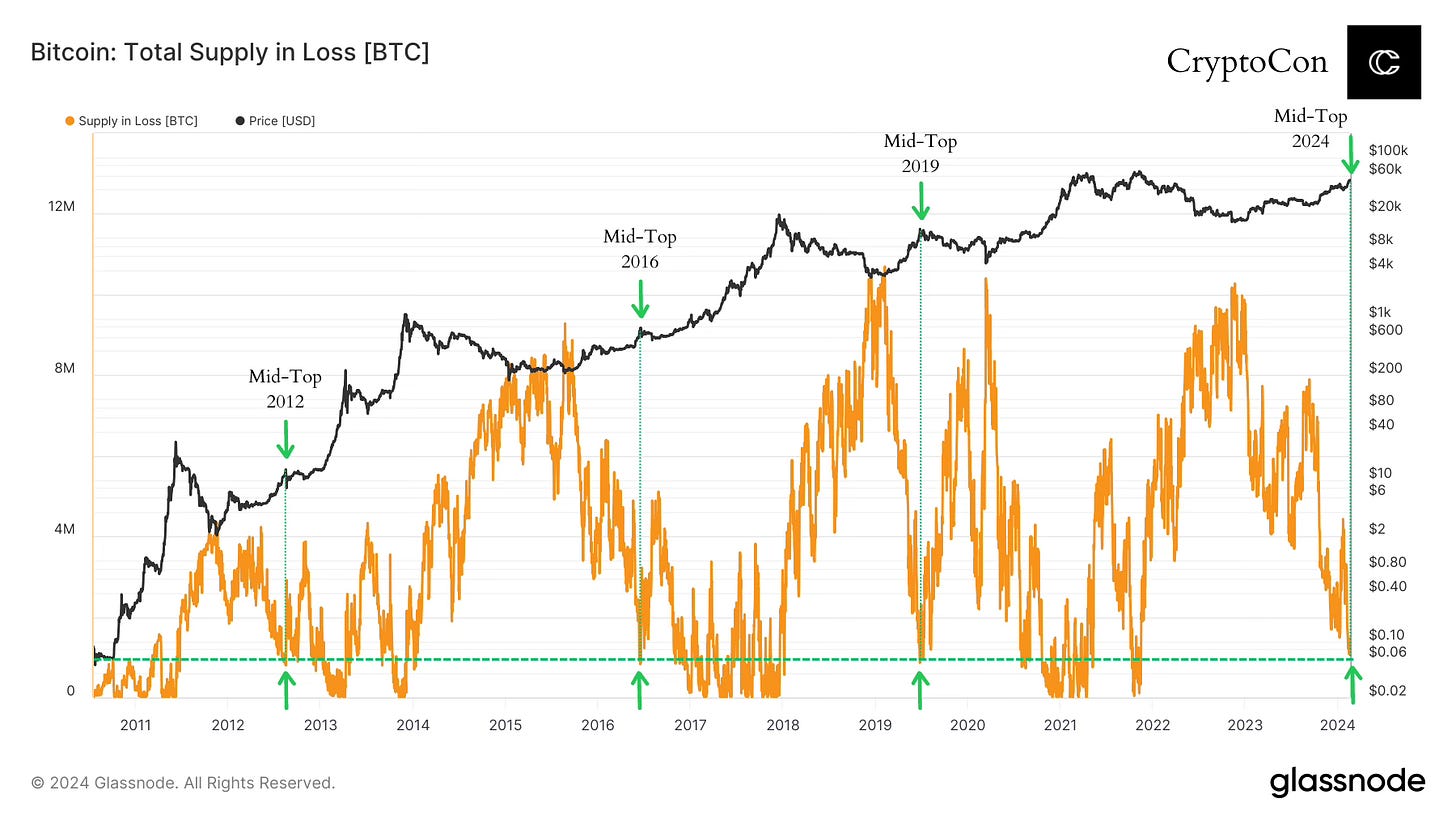

One of those very accurate indicators is shown here: Total Supply in Loss.

Unlike many profit metrics, this shows us the inverse.

Upon the first touch of the green dashed line which marks about 1.2 million coins in loss, it has marked the mid-top in every cycle.

Again the mid-top is a point in the cycle where price takes a decline and starts a long sideways period of about 4 months after the decline is complete.

Our brief 20% decline did not qualify for our typical mid-top correction.

I am interested to see if even the last bits of data do not hold up, in which case I will turn to early cycle top metrics to see if price is entering a parabola.

Still, nothing has changed about what data tells us, it’s overheated, but price is still climbing. I am committed to sharing what the data and cycles tell us while also being open to new possibilities.

Investor Psychology

The Lone Wolf

The majority of people are not long-term thinkers. This applies to investing and life.

To be fair, it is against our nature. Our brains naturally gravitate towards what is easy, and instant. Quick reward.

Delayed gratification is critically important, and simultaneously incredibly difficult.

The more you do the hard things, that will benefit your longer-term self, the better your life will become, but also the more alone you will be.

In a world full of short-term thinkers, you will stick out.

I specifically remember thinking how good of an opportunity Bitcoin was to buy during the 2020 COVID crash. To me, it was a miracle. I had faith that nothing that came of that would destroy the world, and eventually, things would recover.

To others, the outlook seemed grim, because they were focused on the present.

No one cared until everyone did.

At the cycle top in April 2021, everyone I knew was participating in crypto, the exact time I decided to sell.

The same people who wouldn’t touch anything at the lowest prices and thought I was ridiculous, now couldn’t stop talking about it.

I tried to guide as many people in my life as I could to the same decision I made then, but only 1 did. I wish we could have all won together, but in this game, we just can’t.

Just because you’re alone in you’re thinking, doesn’t always mean you’ll be right. But the more you make good informed choices based on data from a multitude of sources, the more alone you’ll find yourself becoming.

Get comfortable in the uncomfortable. Who cares what everyone else is thinking? It is very unlikely they will be successful anyway.

That’s all for today’s newsletter, I hope you enjoyed! If you did, be sure to leave a like on this post, it helps me out a lot.

I hope you all have an amazing week, and I will see you next time!

Best wishes,

CryptoCon

“I want the cycles to remain on track. The longer price takes to reach its destination, the higher it can go. A short parabolic burst will likely end much shallower than many are expecting.”

Well said. The cycles staying on track also helps with, let’s say, predictability with the markets. I’d take predictability over the long term over short term quick profits any day.

You say that all price points have been hit for the mid top, but the MVRV-Z score hasn’t hit yet, correct? 2.11?