Hello Everyone!

It’s been many newsletters of enduring the sideways price action brought to us since March 2024.

Calls for both a recession and a cycle top have become semi-popular as recency bias kicks in. What goes down must continue to go down… right?

Readers of this newsletter would know that I have encouraged patience as price finds its way out of the rut, which I think is inevitable. The influx of newcomers we saw during the sharp rise from October 2023 to March 2024 has now become bored with their shiny toy, but I’m sure they’ll be back to pick it up once it’s polished (new ATHs).

It can be hard to combat evidence of doom, especially with many data points reaching cycle top levels in March 2024 and the seemingly neverending range of 58 - 68k.

But this long correction was hugely important for one thing:

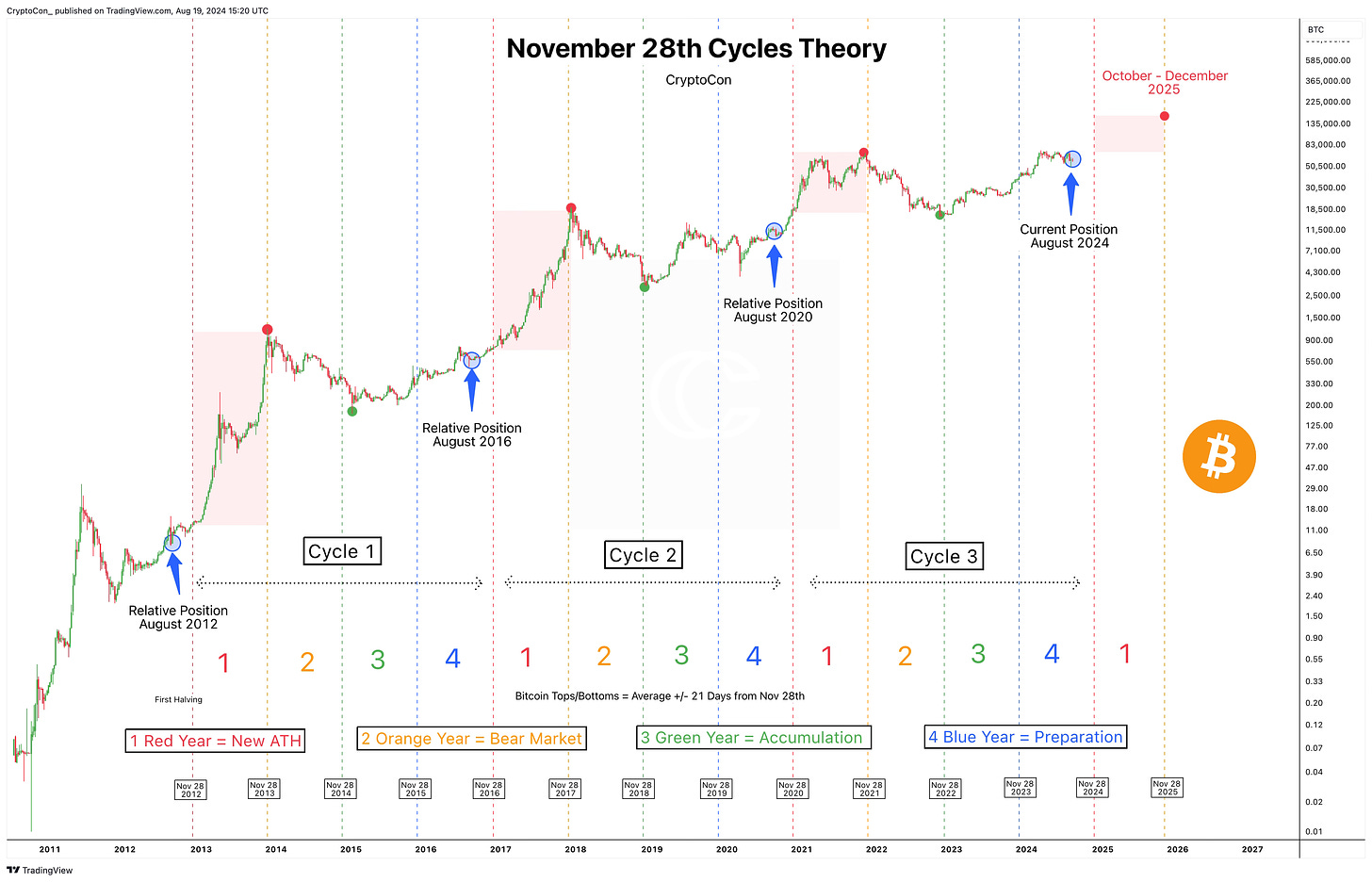

The timing of the original November 28th Cycles Theory. (Which is the same as the Halving Cycles Theory)

In other words, if we wanted a top in late 2025 we were going to need to stop price from rapidly advancing past the ATHs.

And that’s exactly what we’ve got.

Pushing out the time frame for the cycle top allows more room for growth not just for Bitcoin, but Altcoins as well.

March 2024 was a technical analysis trap. A price move made to look different than anything we’ve seen before yet somehow still abide by many of the cycle rules.

But how do we know that 2024 is like these other years and not the cycle top years of 2013, 2017, and 2021?

With cycle top data triggering, how do we know this is not the beginning of the end?

By the end of this newsletter, you will know.

Let’s jump in!

*If you’re new and want to get a feeling of what you’ll get with a subscription be sure to visit the about page here where you can see everything premium has to offer*