Hello Everyone!

In the last Bitcoin Data Newsletter “We’re Going Up, But Can it Stick?”, we talked about whether or not the Bitcoin price rise could continue.

We concluded based on an important downtrend break, and data saying we were at cycle-low levels that yes, Bitcoin was likely to continue.

Since then, price has risen from about $28,300 to now almost $35,000. Quite an impressive Bitcoin pump!

But as you may see from the title of this newsletter, I don’t think it’s over yet.

I think it’s just beginning.

Let’s jump right in!

This Newsletter Will Cover….

Short-Term Thoughts

Market Comments

Long-Term Analysis

Investor Psychology

Short-Term Thoughts

A couple of days ago I introduced some new Bitcoin price bands on X, called Magic Bands.

This is my first price model that tracks smaller moves, most of my models include cycle top targets or are time-based.

These bands have been incredibly accurate, so I will be using them much more frequently in price observations.

Here we’re looking at price action from the 2022 cycle bottom to the current. We’re also focusing on the most relevant magic bands here which are the Bottom Band, to Level 2.

The two price rises we saw earlier this year came at about the same percentage increase and also had similar decreases that followed.

The first move was 63%, with a 22% correction, and the second was a 58% increase with a 20% correction.

I do not think the move highlighted “corrective move” was its own move. Even though price came higher, it was more of an equal high.

Sometimes price can correct by going sideways, and that's what I think we did there.

Pay close attention to how price is drawn to primary and secondary levels like magnets. Primary levels are boxed, and secondary are not.

Primary levels are the targets on an even larger scale.

Currently, price is at an intraband, these are typically unimportant for larger moves, and just act as temporary roadblocks.

Now let’s talk about what I think comes next.

Since price is drawn to the primary and secondary levels, and we’ve just broken above yellow layer 1, our next focus would be layer 1.5. This is priced at $38,832.

Afterwards, we might see a correction back to Level 1 which lines up with other moves. This would be about 18%.

There are many paths that price could take to get to level 1.5, but ultimately, I don’t think we’ll go under level 1 ($31,818) before we get there. It is possible though, that we touch that level beforehand.

I also think the bigger target is Level 2 now that Level 1 is broken through. This is priced at $48,177.

Market Comments

After this massive price rise, Bitcoin is taking some time to cool off which is expected of course.

Surprisingly, I’ve still been seeing people copy-paste black swan fractals calling for massive decline. Their theory now is that war tensions will create the “black swan.”

It’s important to remember that black swan events are unpredictable! That is the entire point. If it were foreseen, it would not be a black swan.

Consider how many times you thought a massive drop was coming, and how many times that happened. For almost all of you, that is probably 0.

Optimists make money, if you assume everything will be just fine you are so much more likely to be successful, it’s just how the market works.

Fear and greed keep you from opportunity at the best points.

I want to be clear on how I think the next Bitcoin move could play out.

First off, I don’t think we’ve made a full top here at $35,000. That doesn’t mean that I don’t think we could see a correction from here, and I think up to Level 1 ($31,818) is on the cards in the event of a drop.

But before a larger correction, I see higher prices in the future. The big targets are Level 1.5 ($38,832), and ultimately Level 2 ($48,177).

The magic bands show that once we break through a primary level, it’s on to the next one. This was the focus of my last premium newsletter, “History Calls for $48,000”

I believe all of this will take place within the next few months.

Overall I’m expecting good things, but not in a straight line of course.

For those who missed out on lower prices to buy, I still think it’s advantageous to wait. What goes up, must come down, eventually.

Before we continue, I want to give a quick shout-out to my premium newsletter.

I have turned down hundreds of scams, promotions, and affiliates to focus on the only thing that I sell, more information to make sure you’re prepared to make the right long-term buying and selling Bitcoin and Altcoin Decisions.

I have three titles under my belt of doing exactly this. Buying Bitcoin under 10k last cycle, selling everything at 54k in April 2021, and now being all in from 16.5k in Nov 2022.

Not only do you get the most information that you need to succeed from someone who has done it, but also these other benefits:

Private Telegram Group Access

Much longer Bitcoin Newsletters and Exclusive Information

*New* Videos (Wednesday - Saturday)

Dollar Cost Averaging Tools to Scale in and Scale out of ETH, BTC and Alts

An Entire Newsletter Dedicated to Altcoins

Premium Charts Page with Live TradingView Charts

Voiceover of Newsletters

Premium Charts page for a live look into my posts in TradingView

Time Sensitive Updates

Full Information on My Long-Term Buy and Sell Decisions

Full Cycle Labs Access

DCA Journey Access (An Account that Follows my DCA Tools)

+ Even more to come!

I have made sure the value is worth the price. Only more is on the horizon. If you want to make sure you are prepared for the right long-term decisions, you can join us right here:

Long-Term Analysis

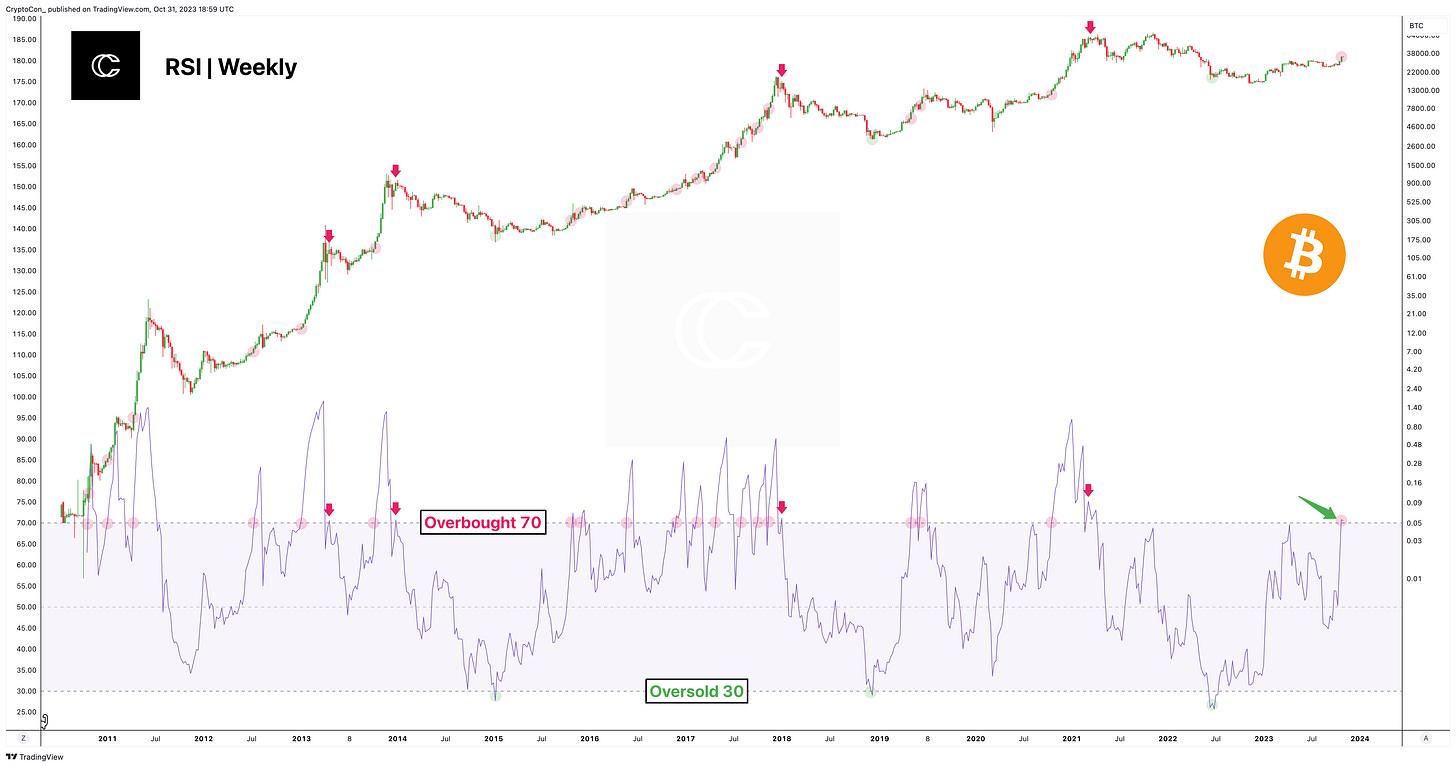

The Weekly RSI has been important for so many areas.

It tells us when the cycle bottom is occurring with a move into oversold (RSI 30). This cycle did have a secondary move lower during the FTX event.

It tells us when the bull market is starting after the second time the metric crosses the mid-line (just happened).

Here, we’re looking at examples where RSI went overbought (RSI 70), and this is not a lackluster occasion.

Be sure to look closely at each example I’ve highlighted here where the RSI goes into overbought territory. The similarity is, that price does not finish here.

A cross into overbought has always brought higher prices, outside of one event which is arrowed, this occurs when Bitcoin is making a lower high from its cycle top. Clearly, we are not at that point in the cycle.

Most times, Bitcoin continues straight up from this point. Even if that is not the case, I think we can say based on this, we are not finished.

Other observations show that we may still need a cool down in the short-term future.

The lowest example was in late 2015 when Bitcoin made a massive wick, causing the metric to close at a lower point:

Had we not seen this wick, RSI would have come much higher.

Going overbought on Weekly RSI seems to be a good thing, and again tells us, this is probably just the beginning.

Investor Psychology

In today’s newsletter, I want to focus our psychology portion on risk/reward.

These two things are inseparable, and directly linked to one another.

The higher the risk, the higher the reward, and vice versa.

Here’s a hard truth, in crypto, it is unlikely you make a substantial amount of money unless you risk a lot of money.

Bitcoin returns are diminishing, and I know that many are expecting ETFs to change that, but there’s a great possibility they won’t.

Do you think institutions will just buy at any price? Why wouldn’t they also try to time the cycles?

It seems to me that people consider these large corporations naive, and they will continuously add Bitcoin through ETFs at a steady rate and never sell.

This also assumes that when data becomes overheated, which I suppose most people think they don’t watch for some reason…and that they’ll just keep on buying and push price to unseen levels.

The point here is that I think you should prepare yourself if returns are heavily diminished.

Altcoins get a bad rap, especially from people who only like Bitcoin, but they are a good way to diversify your risk. They have lower market caps, and price can be moved much more easily.

Otherwise, to get great returns with only Bitcoin, you would have to resort to leverage, or already having huge starting funds.

Consider the amount of money you’d like to make, and then make a realistic plan on how to get there.

You must throw “mass adoption” and the like out of the window for this brainstorming session. Think, what’s the most realistic scenario based on facts, and what does that mean for how much I need to invest, or what I need to buy?

As we start to move into a more positive phase of the cycle, now is the time to be thinking about these things, and preparing for what’s to come.

Does the amount of risk you’ve taken with your portfolio reflect the amount you would like to earn?

That’s all for today’s newsletter, I hope you enjoyed! If you did, be sure to leave a like on this post, it helps me out a lot.

I hope you all have an amazing week, and I will see you next time!

Best wishes,

CryptoCon