Hello Everyone!

Bitcoin has been ranging against the 45k price mark, as I await to see if I was right to think the local high was in at that price.

Volatility is getting low, and the potential ETF approvals that everyone has their eye on couldn’t be closer.

What comes of those and how much will they matter? Only time will tell.

Today marks the start of a brand new year! 2024. Here’s to hoping it’s a great one.

This is also an amazing time to path out my expectations for price.

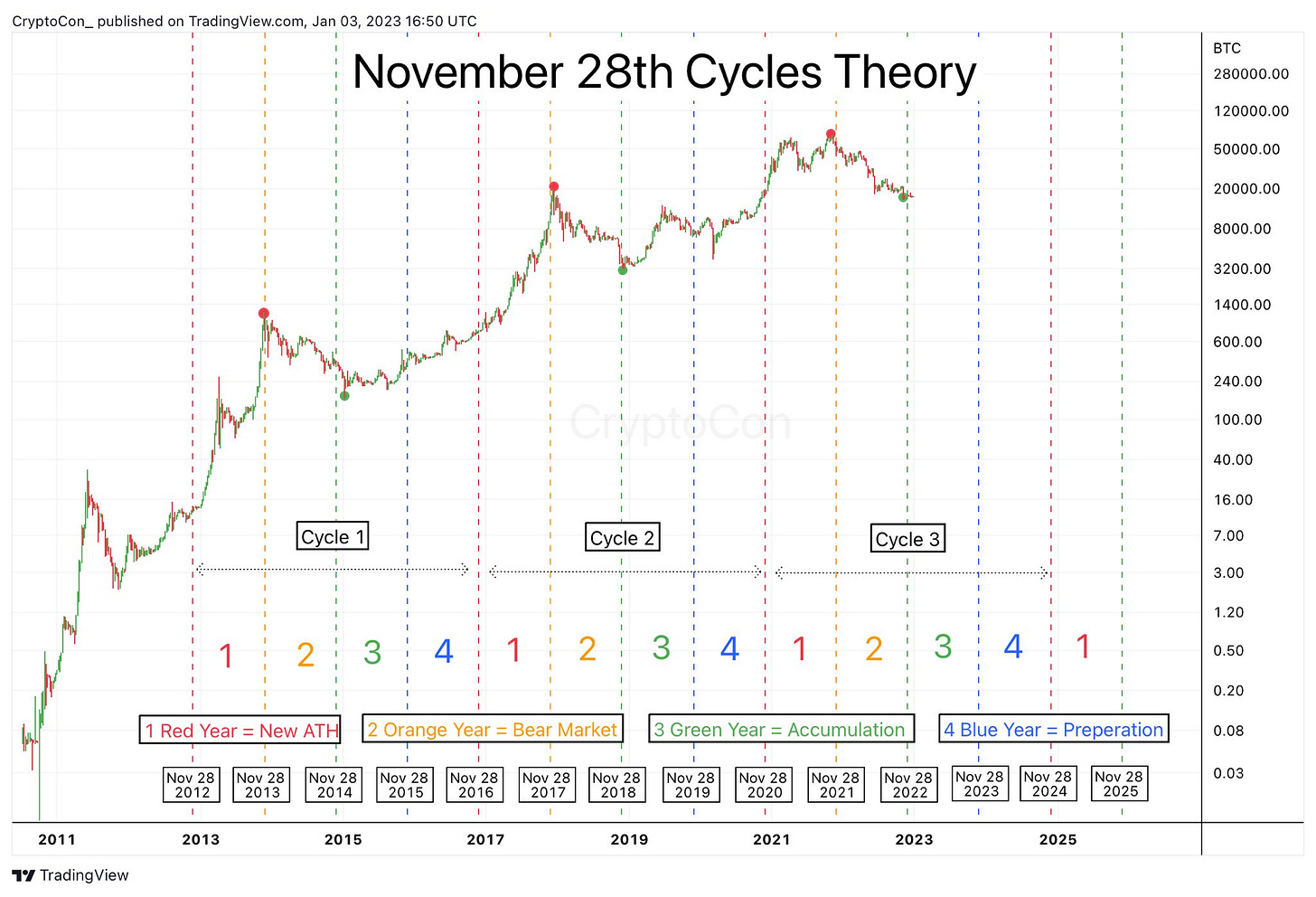

The November 28th Cycles Theory, which I created in January, gave us perfect guidance for 2023:

Alongside the original post, I said the Theory made these claims:

“According to this theory/model, we have reached the maximum error rate at 5 weeks past Nov 28th, making 15.5k almost certainly the bottom at 2 weeks from Nov 28. This year is the accumulation period, offering the best chances to buy Bitcoin, and also a return to the median price.” (34,500)

That was indeed the bottom then, and by the end of this year, we had achieved the median price of $34,500.

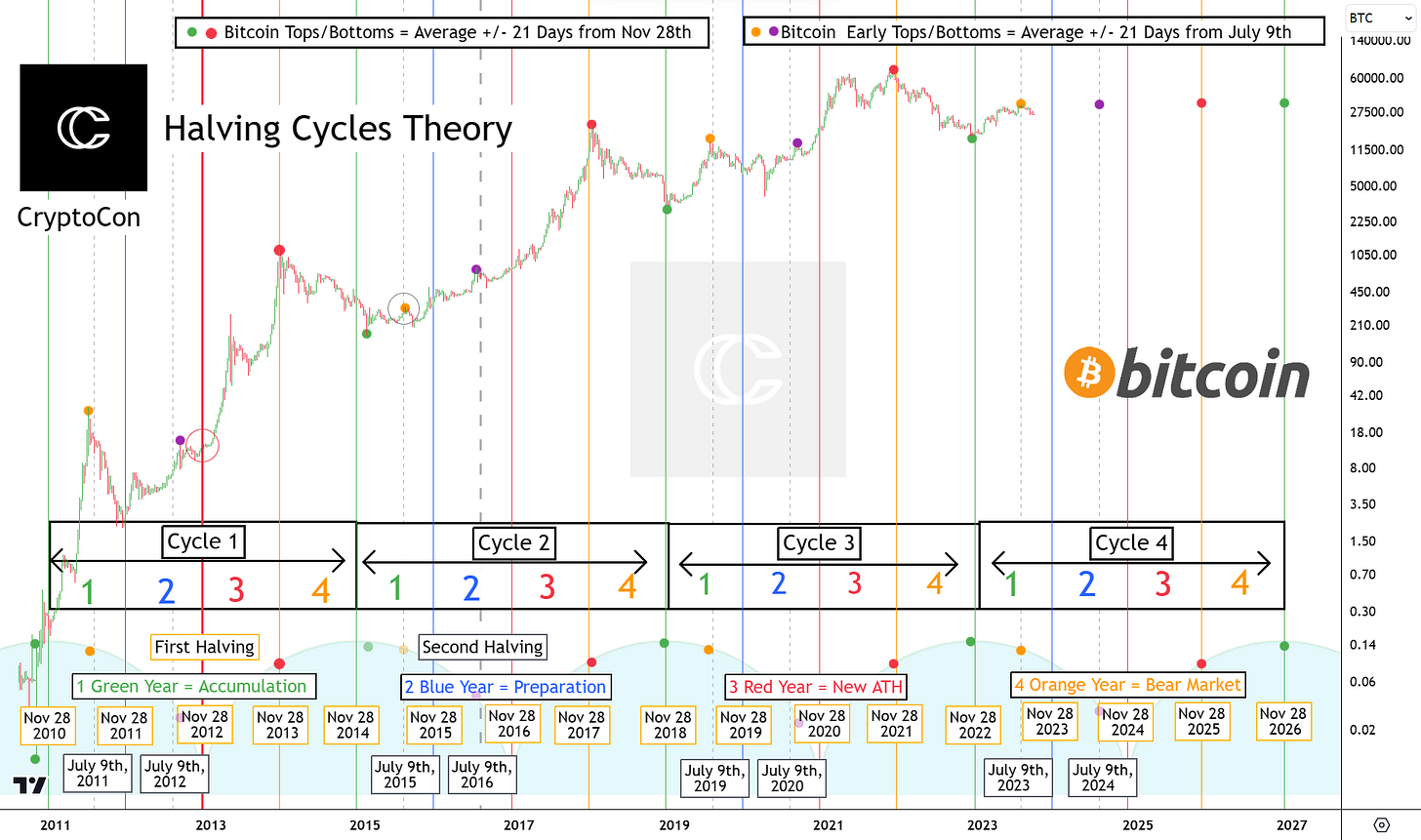

We also deepened our understanding of the cycles with the Halving Cycles Theory:

Upon it’s introduction, I mentioned this:

“Bitcoin will likely now undergo a cool-down period from the first early top, there is still the possibility for rally between now and the next early top.”

The first early top did complete its cool down, and we have since seen the rally between that top and the second early top hitting about 45k.

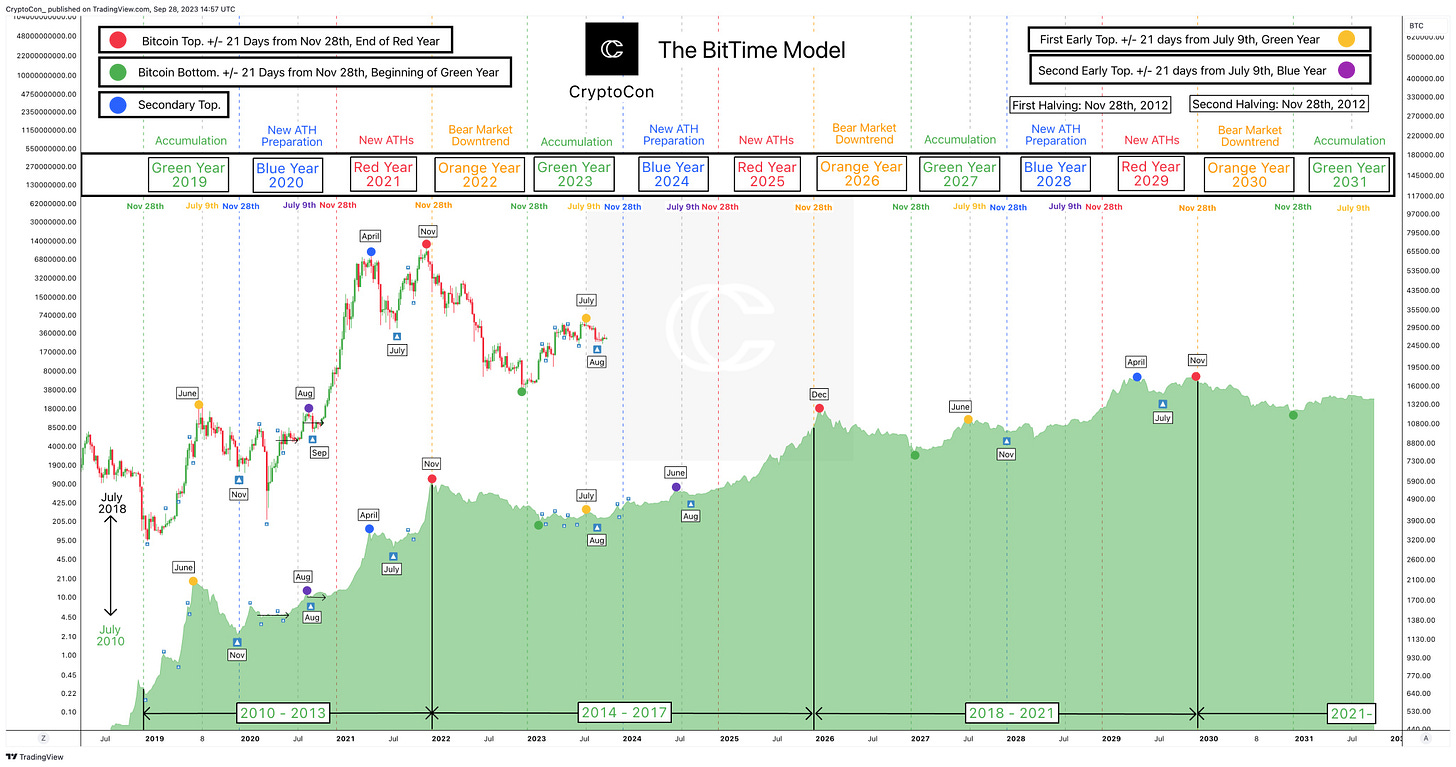

Finally, I introduced BitTime, which completed the picture:

Here was an excerpt from a post I made on BitTime then:

But if BitTime is accurate this month, October will perform well just like it did in 2015 living up to its Uptober name. BitTime says we bottomed in August, like 2015. Not November, like 2019 and 2012. Good things scheduled into early next year!

October did perform extremely well, August was the bottom, and we have continued to see good things up into early 2024.

The cycles are truly powerful.

Of course, all of these models have had some aesthetic updates but remain true to their original ideas.

These cycle models, plus long-term data make for a powerful combo in showing us the way forward for Bitcoin.

Now it’s time to get prepared for 2024. 2023 is locked in the books!

Here are the questions we will answer in today’s newsletter:

How do we know the mid-top is in at 45k?

Where and when do we bottom from this drop?

What price will the Second Early Top be in June 2024?

When do we see new ATHs?

How do ETFs play into these predictions?

What should you do right now?

All to be discussed and more using long-term data from many sources.

I’ll also be laying out a new path for my 2024 expectations both for the short, and long term.

Let’s get started on laying out the roadmap to 2024!

*If you’re new and want to get a feeling of what you’ll get with a subscription be sure to visit the about page here where you can see everything premium has to offer*